What’s Next After the Strikes

One of the toughest years for television in the United States is over! The Writers Guild of America (WGA) voted to end its strike on September 27; The Screen Actors Guild - American Federation of Television and Radio Artists (SAG-AFTRA) strike ended just over a month later, on November 8, 2023. The writers and actors managed to secure better pay, more transparency from streaming services and safeguards from having their work exploited or replaced by artificial intelligence. The strikes also resulted in changes and advancements for future projects, suggesting that the efforts made by unions will have a positive impact on the industry.

2023 proved quite difficult for the entire showbiz industry in the country and while the US writers’ and actors’ strikes are over, the almost six months of production stoppages led to a reduced supply of content. There is also a significant dose of uncertainty about what exactly the new normal might be.

Part of this new normal is the fact that viewers did not feel the effects of the strike that much. As Nielsen outlined in its Top of 2023 report:“while the writers’ strike constrained the stream of new content for the year, the growing abundance of programs and movies across linear and streaming channels continues to engage TV audiences for about half of their daily time with media. TV engagement has normalized following the heights reported during the pandemic, and the explosion of choice is no longer inspiring increases in TV usage. On average, the typical adult spends more than 10 hours each day with media, with about half dedicated to TV content. ”Nielsen’s annual report for 2023 reasserts the importance of traditional TV, while also noting the importance of streaming nowadays: “given the abundance of streamable content, much of which can be watched on demand, streaming has grown to account for a sizable portion of total TV usage, hitting a high-water mark of 38.7% in July 2023. Traditional, scheduled television programming, however, remains a dominant component of the media mix, with broadcast and cable accounting for more than 50% of TV usage throughout the year (53.2% in November). In aggregate, broadcast and cable programming in 2023 through Nov. 30 attracted an audience of 185.1 billion (61.2 billion for broadcast; 123.9 billion for cable).”

The writers’ and actors’ strikes were indicative of a larger industry problem in Hollywood where employees fought for better wages and working conditions, which have been hurt by the rise of streaming. Streaming has changed how viewers watch TV, but it’s also changed how shows are made and how writers and actors are compensated for their work. The 2023 strikes may have contributed to the end of some series, but they also led to a great deal of positive changes for future projects. It will take a lot of time for these projects, however, to appear on the small screen since writers, unlike in previous strikes, completely abandoned their work during the walkouts and focused solely on defending their rights, rather than writing in the meantime.

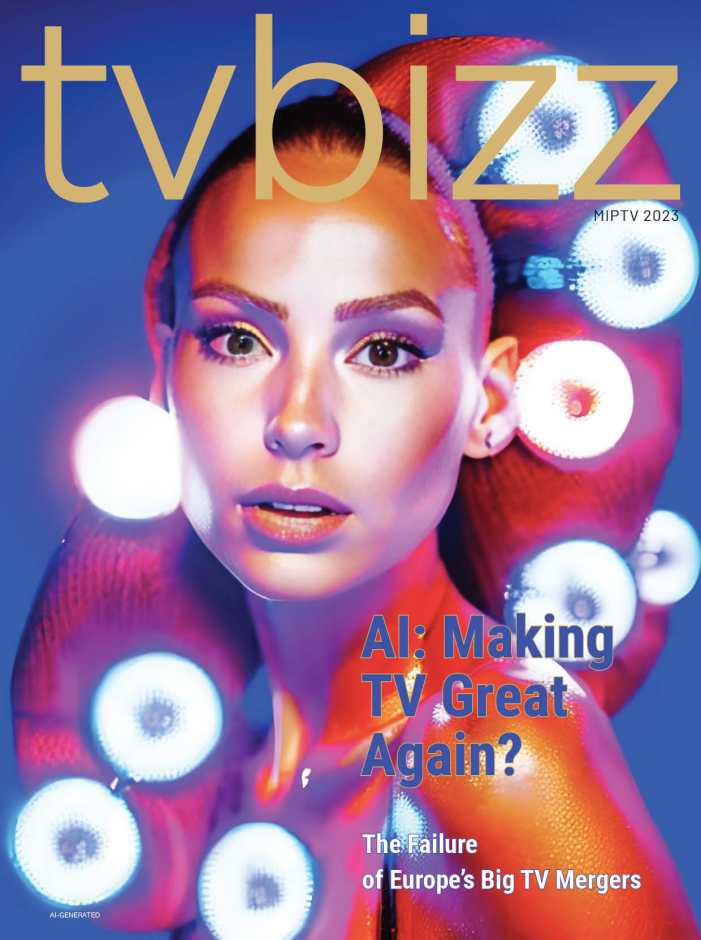

In our MIPCOM issue, we outlined the results of the writers’ strike: the WGA announced that the major wins are in terms of pay increases and AI. The pay increases are significant with notable increases for “high budget subscription video on demand” and streaming films. Essentially, the WGA got what it has been demanding from the start when it comes to AI: AI will not be able to write or rewrite literary material, and AI-generated material will not be used as a source material. In other words, an exec won’t be able to ask ChatGPT to come up with a story and ask writers to turn it into a script that the exec owns the rights to. The WGA also “reserves the right to assert that exploitation of writers’ material to train AI is prohibited by MBA or other law.”

The guild announced that it won guarantees of minimum staffing in writers’ rooms, a key issue for many of its members. Staffing will be determined by the number of episodes per season. Minimum pay rates will climb by more than 12% over three years. Also, residuals will rise for the use of TV shows and movies outside of the United States and a bonus will be awarded for the most popular shows on streaming. Among the bigger wins is also the ability to share in the success of content that performs well on streaming services like Netflix or a residual payment based on viewership, which will be calculated by hours streamed and runtime.

In a major development for the industry, following the deal, studios now will have to provide the WGA with actual data. Specifically “the total number of hours streamed, both domestically and internationally, of self-produced high-budget streaming programs.” Netflix, Disney+, Amazon, and the other streamers won’t be able to come up with weird metrics or meaningless self-referential rankings to give to the WGA.

SAG’s new contract also includes major changes. Actors got an increase in basic wage minimums for a variety of projects for film and television. For anyone with a speaking role, minimums will increase by 7% effective Nov. 9, 2023, another 4% effective July 2024 and another 3.5% effective July 2025. Background actors will get an increase of 11% on Nov. 9 and the same increases as others going forward.

Actors will also get better streaming residuals and bonuses for hit shows and movies, defined as those seen by 20% or more of a streaming service’s domestic subscribers in the first 90 days of release or the first 90 days of any year following that first year of release.

Bonuses will equal 100% of an actor’s residual, but only 75% will go to the actor directly. The other 25% will go to a joint fund managed by reps from both the AMPTP and SAG-AFTRA, who will distribute it to actors in other streaming shows. The idea is to “spread the wealth”.

SAG-AFTRA also got improvements in their pensions and new limits around virtual auditions, which can get costly and take up more time than auditions have in the past. Performers are to be sent audition material at least 48 hours in advance, have new guidelines around memorizing text and may not be asked to use a delivery site that isn’t free, among other parameters.

As in the Writers’ Guild of America (WGA) strike that ended in October, studios’ growing use of generative AI was one of the final issues to be resolved in the SAG-AFTRA strike.The new contract creates protections around various scenarios in which AI would come into play. This includes consent and compensation around digital replicas created while an actor’s working on a given project; consent and compensation around digital replicas created outside the scope of a project; and digital alterations to an actor’s performance.

Another phenomenon which can be attributed partially to the strikes was Suits’growing popularity in 2023. As Nielsen writes in its annual report “with the lines between traditional and streaming growing increasingly blurry, it seems overly fitting that the biggest streaming story of the year involved a program that first ran on cable between 2011 and 2019 before landing on Peacock and Netflix. While the writers’ strike had an impact on new content this year, the popularity of Suits was undeniable, landing in the top spot of Nielsen’s top 10 list for a record 12 straight weeks—longer than Netflix originals Ozark (11 weeks), You (8 weeks) and Stranger Things (8 weeks). During its 12-week run at the top, audiences watched more than 36.8 billion minutes of the legal dramedy.”

The studios warned that if a tentative agreement was not reached by the end of last year, the 2023-24 TV season would have been lost, and this summer’s theatrical season would have been crippled. Things are not looking that bad now but certainly not rosy either. As Deadline wrote on December 28: “while there was a trickle of pitches in November and early December — a handful of them selling in competitive situations with big commitments including the Octavia Spencer-Hannah Waddingham comedy, which landed a straight-to-series order at Prime Video — the proverbial floodgates are expected to open in January for an influx of big packages. Bidding wars are likely but the overall level of offered commitments will be indicative of how much the industry’s ongoing contraction and increased fiscal discipline have taken hold.”

Part of this new normal is the fact that viewers did not feel the effects of the strike that much. As Nielsen outlined in its Top of 2023 report:“while the writers’ strike constrained the stream of new content for the year, the growing abundance of programs and movies across linear and streaming channels continues to engage TV audiences for about half of their daily time with media. TV engagement has normalized following the heights reported during the pandemic, and the explosion of choice is no longer inspiring increases in TV usage. On average, the typical adult spends more than 10 hours each day with media, with about half dedicated to TV content. ”Nielsen’s annual report for 2023 reasserts the importance of traditional TV, while also noting the importance of streaming nowadays: “given the abundance of streamable content, much of which can be watched on demand, streaming has grown to account for a sizable portion of total TV usage, hitting a high-water mark of 38.7% in July 2023. Traditional, scheduled television programming, however, remains a dominant component of the media mix, with broadcast and cable accounting for more than 50% of TV usage throughout the year (53.2% in November). In aggregate, broadcast and cable programming in 2023 through Nov. 30 attracted an audience of 185.1 billion (61.2 billion for broadcast; 123.9 billion for cable).”

The writers’ and actors’ strikes were indicative of a larger industry problem in Hollywood where employees fought for better wages and working conditions, which have been hurt by the rise of streaming. Streaming has changed how viewers watch TV, but it’s also changed how shows are made and how writers and actors are compensated for their work. The 2023 strikes may have contributed to the end of some series, but they also led to a great deal of positive changes for future projects. It will take a lot of time for these projects, however, to appear on the small screen since writers, unlike in previous strikes, completely abandoned their work during the walkouts and focused solely on defending their rights, rather than writing in the meantime.

In our MIPCOM issue, we outlined the results of the writers’ strike: the WGA announced that the major wins are in terms of pay increases and AI. The pay increases are significant with notable increases for “high budget subscription video on demand” and streaming films. Essentially, the WGA got what it has been demanding from the start when it comes to AI: AI will not be able to write or rewrite literary material, and AI-generated material will not be used as a source material. In other words, an exec won’t be able to ask ChatGPT to come up with a story and ask writers to turn it into a script that the exec owns the rights to. The WGA also “reserves the right to assert that exploitation of writers’ material to train AI is prohibited by MBA or other law.”

The guild announced that it won guarantees of minimum staffing in writers’ rooms, a key issue for many of its members. Staffing will be determined by the number of episodes per season. Minimum pay rates will climb by more than 12% over three years. Also, residuals will rise for the use of TV shows and movies outside of the United States and a bonus will be awarded for the most popular shows on streaming. Among the bigger wins is also the ability to share in the success of content that performs well on streaming services like Netflix or a residual payment based on viewership, which will be calculated by hours streamed and runtime.

In a major development for the industry, following the deal, studios now will have to provide the WGA with actual data. Specifically “the total number of hours streamed, both domestically and internationally, of self-produced high-budget streaming programs.” Netflix, Disney+, Amazon, and the other streamers won’t be able to come up with weird metrics or meaningless self-referential rankings to give to the WGA.

SAG’s new contract also includes major changes. Actors got an increase in basic wage minimums for a variety of projects for film and television. For anyone with a speaking role, minimums will increase by 7% effective Nov. 9, 2023, another 4% effective July 2024 and another 3.5% effective July 2025. Background actors will get an increase of 11% on Nov. 9 and the same increases as others going forward.

Actors will also get better streaming residuals and bonuses for hit shows and movies, defined as those seen by 20% or more of a streaming service’s domestic subscribers in the first 90 days of release or the first 90 days of any year following that first year of release.

Bonuses will equal 100% of an actor’s residual, but only 75% will go to the actor directly. The other 25% will go to a joint fund managed by reps from both the AMPTP and SAG-AFTRA, who will distribute it to actors in other streaming shows. The idea is to “spread the wealth”.

SAG-AFTRA also got improvements in their pensions and new limits around virtual auditions, which can get costly and take up more time than auditions have in the past. Performers are to be sent audition material at least 48 hours in advance, have new guidelines around memorizing text and may not be asked to use a delivery site that isn’t free, among other parameters.

As in the Writers’ Guild of America (WGA) strike that ended in October, studios’ growing use of generative AI was one of the final issues to be resolved in the SAG-AFTRA strike.The new contract creates protections around various scenarios in which AI would come into play. This includes consent and compensation around digital replicas created while an actor’s working on a given project; consent and compensation around digital replicas created outside the scope of a project; and digital alterations to an actor’s performance.

Another phenomenon which can be attributed partially to the strikes was Suits’growing popularity in 2023. As Nielsen writes in its annual report “with the lines between traditional and streaming growing increasingly blurry, it seems overly fitting that the biggest streaming story of the year involved a program that first ran on cable between 2011 and 2019 before landing on Peacock and Netflix. While the writers’ strike had an impact on new content this year, the popularity of Suits was undeniable, landing in the top spot of Nielsen’s top 10 list for a record 12 straight weeks—longer than Netflix originals Ozark (11 weeks), You (8 weeks) and Stranger Things (8 weeks). During its 12-week run at the top, audiences watched more than 36.8 billion minutes of the legal dramedy.”

The studios warned that if a tentative agreement was not reached by the end of last year, the 2023-24 TV season would have been lost, and this summer’s theatrical season would have been crippled. Things are not looking that bad now but certainly not rosy either. As Deadline wrote on December 28: “while there was a trickle of pitches in November and early December — a handful of them selling in competitive situations with big commitments including the Octavia Spencer-Hannah Waddingham comedy, which landed a straight-to-series order at Prime Video — the proverbial floodgates are expected to open in January for an influx of big packages. Bidding wars are likely but the overall level of offered commitments will be indicative of how much the industry’s ongoing contraction and increased fiscal discipline have taken hold.”