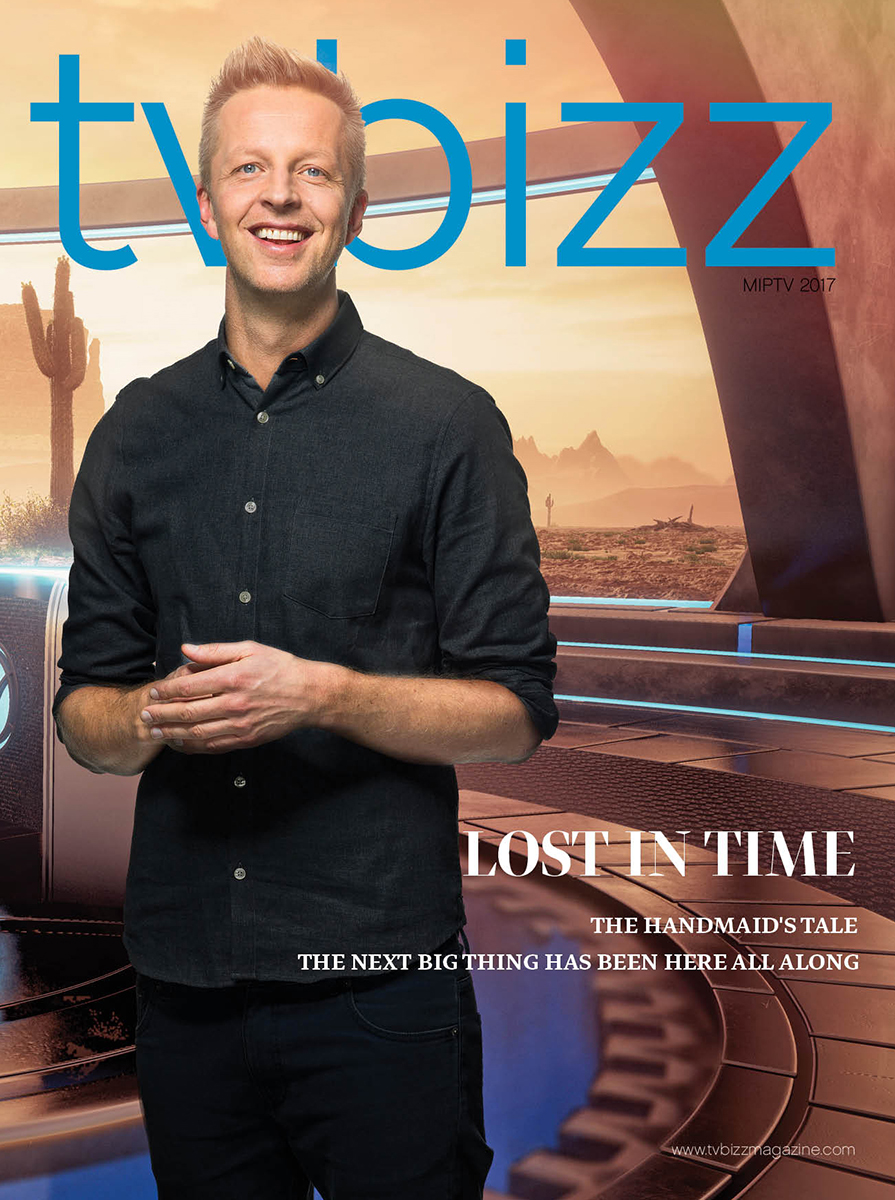

Coming to NATPE Budapest: Kim Poder, Antenna Group Chief Operating Officer

Kim Poder, Antenna Group Chief Operating Officer, will be one of the top speakers at the upcoming NATPE Budapest with the premiere of Brunico’s Fireside Chats in Budapest.

In this exclusive interview, Mr. Poder talks in detail about the international business of Antenna Group and the potential for growth and new investments in the CEE region, as well as the success of the flagship operation in Greece and in particular the streaming platform ANT1+.

In this exclusive interview, Mr. Poder talks in detail about the international business of Antenna Group and the potential for growth and new investments in the CEE region, as well as the success of the flagship operation in Greece and in particular the streaming platform ANT1+.

Kim Poder, Antenna Group Chief Operating Officer

Kim, you are the COO of Antenna Group which operates free-to-air television channels in Greece and Romania and pay TV channels that are broadcast in over 40 countries. What are your day-to-day responsibilities within such a large media holding?

Besides my role as Group COO I’m acting CEO of our international business, so until we have find the right candidate for this role I’m overseeing the tv-business in the CEE (headquartered in Budapest), our significant radio business in Romania, our international pay-tv business (for Greek Diaspora) and Antenna Digital Ventures. In my role as COO I have the privilege of working with the teams in Greece (where I live), with the aim to help improving our business performance.

You are attending CEE's most-established content market NATPE Budapest this year and you will be one of the key speakers at the event. What will be the main topics that you will focus on during your fireside chat?

I hope to send a clear message to the audience, that we are in this region because we believe it has so many growth opportunities and we want to invest not only in the current operation but also in new business opportunities. I hope this invitation will create new partnership opportunities for us.

Let’s focus on Antenna’s operations. How many TV channels and streaming services does your company operate currently and what is your strategy in terms of expanding the business?

We operate 22 pay and free channels and three regionalized versions of a Greek ptv-channel in US, Australia and in Europe. In addition to this, our radio business in Romania offers 3 music tv channels. Our streaming service in Greece, Ant+, is the only local premium SVOD service in the market.

We are definitely looking for expansion in the CEE where we are unique in terms of the footprint covering multiple markets and with a very efficient operation, but if you look at Antenna Greece, you understand that there is so much more we copy and do in CEE.

In 2021, Antenna Group took over the channels formerly operated by Sony Pictures Television Network. Are you satisfied with the results of your CEE cable portfolio? What are your plans for the AXN and VIASAT channels and on-demand platforms in the region?

We are never 100% satisfied and constantly we strive for improvements. But overall, I’m very proud of the performance and the team. This year we really see the results of the hard work, and the channel performance in the 3 biggest markets Hungary, Poland and Romania is very solid. Competition is fierce, so success tastes even better.

Today we offer our content on linear and on demand via the operators but on demand is definitely an investment opportunity and focus area for us. It’s too early for me to share how we will approach this.

You also started the process of restructuring and optimization of Antenna Entertainment last year. Has it been completed?

Yes, this has almost been completed. The missing piece is the CEO of the region.

What is your strategy as regards producing original content in the CEE region? Will this be limited only to Hungary or are you planning original productions on a pan-regional level?

Content is our passion, so this is something we discuss every day. Viasat3 is known also for local content, but the true foundation of our TV-channels is premium content we acquire. And buying for multiple markets it obviously very efficient. But in all of our markets we try to add local content and flavor to make the channels more distinct. We don’t have to produce our own local content – partnering with other broadcasters and/or operators sharing right with is also an opportunity. In Hungary, as an example we have expanded our partnership with RTL and are able to offer some of their high quality content.

The cable TV market in CEE is quite competitive. Do you have different strategies in the different CEE territories when it comes to distribution and monetization?

Not really. Our monetization model in all of our markets aim to have both carriage revenues and ad sales. Carriage revenues is a prerequisite. This means, we are not only here to increase the share, but to offer unique and relevant channels that add value to the operators offers.

In your opinion, what is the potential of the Greek creative industry and what is needed for Greek TV productions to reach a wider international audience?

I think, we have all seen how content has no borders, if the stories and the productions are good. The number of scripted formats that are being produced in Greece is enormous and this means more even more talents and better quality. We see it as our job, to distribute and showcase Antennas premium content in all of our own markets and globally.

ANT1+ is perhaps the only paid Greek streaming platform, while your rivals prefer to offer their content for free online. What makes ANT1+ different and successful?

We offer both free and paid access which benefits both us and the users. Being first mover is a huge advantage. We have more than 2 years of experience and literally millions of datapoints, we can use when we commission local content, acquired and sports. Streaming is not only about great content – it’s also a tech and marketing game and to learn from mistakes and to know how to satisfy a paying subscriber base and develop the service, is not something you learn overnight.

There have been reports that you are planning a partnership with Mega in terms of series production and streaming to create the biggest Greek content platform. At what stage is that project at the moment?

We never comment on rumors and there are always many of those in our amazing industry.

FAST channels have become very popular in many territories around the world, with the CEE region and territories like Poland also seeing the launch of such channels. What is Antenna Group's strategy in this respect. Have you considered expanding your business model?

As mentioned, our channels in the CEE region are to a large extend paid by subscription revenues. I don’t rule it out, but to enhance the partnership with the operators and to explore SVOD opportunities is more important.

Going back in time, in 2000, Antenna acquired Nova TV Bulgaria for $3 million and sold it in 2008 for $970 million to Modern Times Group, which is still one of the largest returns on investment ever achieved by a European media company. What is Antenna's strategy for M&A in CEE and do you think such record deals can happen again?

Antenna Group has an impressive track record when it comes to return on our investments. We set the bar high, but I think we can live with lower returns. Investing in this region is something we strongly believe in and we are committed to do so. We are keeping our eyes and minds open 24/7 and are hoping for a few inbounds with this invitation.

Previously, you also owned leading FTA channels in Serbia and Slovenia. Are you eyeing a return or other potential markets for new investments?

That is also on our radar, yes.

In your opinion, compared to Western markets, what makes CEE such a strong market for television ventures?

TV viewing is really high in this region and the markets are growing. If I look at the Nordic markets for example, they are in many aspects more developed (digitalized), but they struggle to find growth opportunities and the TV ad markets are in decline. Access to TV packages in this region are cheap, and I’m sure we can all monetize content better. Personally, I believe in building partnerships and I hope we can take lead and find news ways to grow our business in this region through existing and new partnerships.

Besides my role as Group COO I’m acting CEO of our international business, so until we have find the right candidate for this role I’m overseeing the tv-business in the CEE (headquartered in Budapest), our significant radio business in Romania, our international pay-tv business (for Greek Diaspora) and Antenna Digital Ventures. In my role as COO I have the privilege of working with the teams in Greece (where I live), with the aim to help improving our business performance.

You are attending CEE's most-established content market NATPE Budapest this year and you will be one of the key speakers at the event. What will be the main topics that you will focus on during your fireside chat?

I hope to send a clear message to the audience, that we are in this region because we believe it has so many growth opportunities and we want to invest not only in the current operation but also in new business opportunities. I hope this invitation will create new partnership opportunities for us.

Let’s focus on Antenna’s operations. How many TV channels and streaming services does your company operate currently and what is your strategy in terms of expanding the business?

We operate 22 pay and free channels and three regionalized versions of a Greek ptv-channel in US, Australia and in Europe. In addition to this, our radio business in Romania offers 3 music tv channels. Our streaming service in Greece, Ant+, is the only local premium SVOD service in the market.

We are definitely looking for expansion in the CEE where we are unique in terms of the footprint covering multiple markets and with a very efficient operation, but if you look at Antenna Greece, you understand that there is so much more we copy and do in CEE.

In 2021, Antenna Group took over the channels formerly operated by Sony Pictures Television Network. Are you satisfied with the results of your CEE cable portfolio? What are your plans for the AXN and VIASAT channels and on-demand platforms in the region?

We are never 100% satisfied and constantly we strive for improvements. But overall, I’m very proud of the performance and the team. This year we really see the results of the hard work, and the channel performance in the 3 biggest markets Hungary, Poland and Romania is very solid. Competition is fierce, so success tastes even better.

Today we offer our content on linear and on demand via the operators but on demand is definitely an investment opportunity and focus area for us. It’s too early for me to share how we will approach this.

You also started the process of restructuring and optimization of Antenna Entertainment last year. Has it been completed?

Yes, this has almost been completed. The missing piece is the CEO of the region.

What is your strategy as regards producing original content in the CEE region? Will this be limited only to Hungary or are you planning original productions on a pan-regional level?

Content is our passion, so this is something we discuss every day. Viasat3 is known also for local content, but the true foundation of our TV-channels is premium content we acquire. And buying for multiple markets it obviously very efficient. But in all of our markets we try to add local content and flavor to make the channels more distinct. We don’t have to produce our own local content – partnering with other broadcasters and/or operators sharing right with is also an opportunity. In Hungary, as an example we have expanded our partnership with RTL and are able to offer some of their high quality content.

The cable TV market in CEE is quite competitive. Do you have different strategies in the different CEE territories when it comes to distribution and monetization?

Not really. Our monetization model in all of our markets aim to have both carriage revenues and ad sales. Carriage revenues is a prerequisite. This means, we are not only here to increase the share, but to offer unique and relevant channels that add value to the operators offers.

In your opinion, what is the potential of the Greek creative industry and what is needed for Greek TV productions to reach a wider international audience?

I think, we have all seen how content has no borders, if the stories and the productions are good. The number of scripted formats that are being produced in Greece is enormous and this means more even more talents and better quality. We see it as our job, to distribute and showcase Antennas premium content in all of our own markets and globally.

ANT1+ is perhaps the only paid Greek streaming platform, while your rivals prefer to offer their content for free online. What makes ANT1+ different and successful?

We offer both free and paid access which benefits both us and the users. Being first mover is a huge advantage. We have more than 2 years of experience and literally millions of datapoints, we can use when we commission local content, acquired and sports. Streaming is not only about great content – it’s also a tech and marketing game and to learn from mistakes and to know how to satisfy a paying subscriber base and develop the service, is not something you learn overnight.

There have been reports that you are planning a partnership with Mega in terms of series production and streaming to create the biggest Greek content platform. At what stage is that project at the moment?

We never comment on rumors and there are always many of those in our amazing industry.

FAST channels have become very popular in many territories around the world, with the CEE region and territories like Poland also seeing the launch of such channels. What is Antenna Group's strategy in this respect. Have you considered expanding your business model?

As mentioned, our channels in the CEE region are to a large extend paid by subscription revenues. I don’t rule it out, but to enhance the partnership with the operators and to explore SVOD opportunities is more important.

Going back in time, in 2000, Antenna acquired Nova TV Bulgaria for $3 million and sold it in 2008 for $970 million to Modern Times Group, which is still one of the largest returns on investment ever achieved by a European media company. What is Antenna's strategy for M&A in CEE and do you think such record deals can happen again?

Antenna Group has an impressive track record when it comes to return on our investments. We set the bar high, but I think we can live with lower returns. Investing in this region is something we strongly believe in and we are committed to do so. We are keeping our eyes and minds open 24/7 and are hoping for a few inbounds with this invitation.

Previously, you also owned leading FTA channels in Serbia and Slovenia. Are you eyeing a return or other potential markets for new investments?

That is also on our radar, yes.

In your opinion, compared to Western markets, what makes CEE such a strong market for television ventures?

TV viewing is really high in this region and the markets are growing. If I look at the Nordic markets for example, they are in many aspects more developed (digitalized), but they struggle to find growth opportunities and the TV ad markets are in decline. Access to TV packages in this region are cheap, and I’m sure we can all monetize content better. Personally, I believe in building partnerships and I hope we can take lead and find news ways to grow our business in this region through existing and new partnerships.