Jamie Cooke, Group SVP and GM CEE, Middle East, Northern Africa and Turkey, Warner Bros. Discovery: "Our Goal is to be in the Top 3 Streamers"

Jamie Cooke was one of the keynote speakers at NEM Dubrovnik this year. In a keynote Q&A session the senior executive who is responsible for Warner Bros. Discovery's business across CEE talked with Stewart Clarke, SVP, Content, International, Deadline, about the streaming wars entering a new phase, the company's ambitious plans to become with Max one of the top 3 streaming services in the next 3-5 years, WBD's acquisition of BluTV in Turkey and also their plans for local content.

Jamie Cooke, Group SVP and GM CEE, Middle East, Northern Africa and Turkey, Warner Bros. Discovery

Since the merger of Warner and Discovery, Jamie Cooke has been responsible for Warner Brothers Discovery’s business across the Central Eastern Europe, Middle East and North African markets. Jamie works to connect and to maximize all lines of business for WBD. Jamie is also responsible for non-scripted content acquisition across EMEA, the portfolio of Discovery networks across EMEA and an in-house creative agency. Cooke worked for a number of years in EMEA roles, most recently as the GM for CEE and MENAT and as Chief of Staff for the EMEA region working on multi market projects as well as leading the People and Culture function across EMEA in Discovery.

Cooke opened his keynote with some observations from a global perspective, noting that the so-called streaming wars have entered a new phase: "In the last four or five years there was a de-aggregation of services with this kind of perception that you could create a really niche product for different consumer groups, heavy content investment. That kind of phase of the war is over. What I would say is that it's turning more into a Cold War. People are kind of aligning, figuring out who they can work with, an acceptance that there is a need to come together more. A few things we have done ourselves - bringing together of HBO Max and Discovery+ internally, and that's one of the reasons that the merger happened; we've also announced that we're going to be bundling with Disney in the US and we're creating a sports joint venture in the US. I think the war as it was, which was all about heavy investment, de-aggregation, that phase is done, we're entering into a slightly different phase now."

Talking about the newly launched Max streaming service, which is available in 65 territories, 25 in Europe, Cooke noted that "the successes that I've seen over the last year are when those moments the company's really focused on one thing - the launch of Max is a good example of that because it literally has been all pieces of the company pulling in one direction - there's a kind of familiarity now and an acceptance that we're heading in that direction". The three main pillars of a successful streaming operation according to the exec are: "profitability - I think now, at least for us and our shareholders and the stock market generally; scale - one of the advantages we've got is that we're only in 50% of what we see as addressable markets, so I think there's a lot of headroom for us to go; the third sign of success is engagement on the platform - there are many ways to get your product out to consumers, whether direct to consumer or a lot of the time through partnerships, which are really, really important, but you need the engagement on the platform."

The WBD GM for CEE described the region's market as highly competitive. "There is a combination of the global platforms like ourselves that are obviously in or entering the markets. You have really strong local streaming players as well, individual markets, but more likely multi-territory markets. And frankly, the partners that we work with, they do a really, really good job at curating the content and the services for consumers. So, I think it's really, really competitive - I'm not sure that in the end that everyone will be able to survive... It's incumbent on people to figure out how they work together, because the content is all great on all the platforms - the problem is accessing it. At the moment, it's quite fragmented still. And again, that's why I quite like the work that the telcos in the market that we deal with, and they do a very good job of putting it all together. And I do think that is where things are going to start to head." As far as how many streaming services people need in CEE, Cooke said that it varies by country but WBD's ambition is to be in the Top 3. "There's probably room for three services or a combination of global and local. I also think that this whole concept of the streaming war and the way we compartmentalize is a bit lazy. The lines between what is an SVOD service, and then an AVOD service, and then a VOD for broadcast, BVOD service, and FAST channels - I think it's so complicated now, and it's all about getting the content to consumers in all the different ways that they want... I don't think we're at a settled point yet, it depends on markets, but some of the markets that I work in have major piracy issues. And so actually, in a way, you need more great streaming services so that you can convince people that it's worth paying for stuff, because at the moment they're able to get it for free. I don't know where the limit is, and I guess some of it, it's not a fixed thing either, because as individual economies grow, people have more free cash to spend."

In terms of linear TV and the HBO brand in CEE, Cooke said: "I talk about cash cows and there are different type of cash cows - you can choose to have a cow that's like nice and plump in a green field, or you can choose to have a very skinny cow in a desert somewhere. And so, the way I think about our traditional linear networks is in that way. I don't think you should accelerate their decline, there's so many different ways to consume content. You have to make balanced decisions market by market. We've made decisions that might seem counterintuitive. We launched a free-to-air channel in Czech Republic (Warner TV), in MENA. And actually, we see pretty solid growth on ad sales from linear channels. So, you could say, okay, well, that's a declining thing, you shouldn't put money into it. And we have these debates internally about the music industry. You could see what was happening with Spotify, and you have a choice to drive further into the decline, to come out quicker. I'm not sure that's the right approach for these markets, because there is still a big consumer habit to watch linear channels, even on streaming, and again, this is where the streaming and linear blurs. We acquired a streaming service in Turkey called BluTV and roughly 25% of the viewership on BluTV is on linear channels. They're paying subscribers, it's IP delivered on any device, but they're going in and watching linear broadcast... You have to treat that heritage (HBO) with the respect it deserves, and you have to balance the decision to maybe move away from linear channels faster than you need to, and I don't think we need to do that with the HBO linear channels. They do a fantastic job at getting consumers access to the content."

Cooke noted that there's a place for local content on Max: "If I go back to one of the key criteria for us, which is profitability, we had to make some tough decisions, and this was a topic at last year's conference, about shutting down our HBO scripted unit. And when you look at the impact that not having that content on the services had on profitability, on subscribers, it hasn't had a massive negative impact, negligible impact. So, I think that, on the other hand, there are other places where you can have a breakout hit and it does really, really well. I think there is definitely a role for local content, what I would look for is content that can travel. But there's a nuance there - you can end up with a very vanilla content if you try to go out with the premise that we're going to make something that's going to work in 50 countries. We have a group that actually looks at multi-market content creation - the process we have is it starts in a local market, and they say this is a great story for this market and then the team will go 'great, that will also work in other places'. And then we will top that up for co-production, expanding the rights - for example shows like Border Control Spain that does phenomenally well everywhere - it just came out of the Spanish team, it's something that we then develop further and can then spread. If you're approaching the local content from 'I'm making it for every market', you're going to fail. If you approach it from 'I'm making it for this local market and this local market only' I think that's fine, but that's not for us - that's the world of probably the free-to-air broadcasters. If you're making content that is really good in this market and it has a resonance that can go into other places, that can work anywhere in my mind. Yesterday with my team we talked about the 'Nasty' (a documentary about the ’70s Romanian tennis player Ilie Nastase, ed) which is about nostalgia, that kind of thing. It taps into a zeitgeist of a period of time, a known figure, sports. The BluTV platform we bought was pretty much fully based on local content. However, The Last of Us, that aired and premiered there, did just as well as their best performing local show. So, the question is not about one or the other, it's about how many you need of each, in my mind."

Talking specifically about the acquisition of BluTV in Turkey, the WBD exec once again underlined the three pillars for the company: "Profitability, scale, engagement - if you've got a choice to launch a product on your own in Turkey, a very difficult market to penetrate, very competitive, you could choose to do that and you could sink a load of cash into that and that may work. Or you can buy an established pipeline of content, a strong subscriber base - they have about 1.3, 1.4 million subscribers and a highly engaged audience around that content. So, it ticks all the boxes. We know that Turkish content works very well in this region, in Latin America. Interestingly, it's starting to work in Italy, where we've started to air on some free-to-air channels - I've got one eye on how we start to tap into that content to develop stuff that we can use and create Max globally, because we know that stuff works."

As far as what his strategy is of making Max one of the top 3 streamers in the region, Cooke said: "We have a lot of headroom to grow and that is going to really help us get to that top three global player because we've just launched in Europe, we have Asia to come and then we have potentially second wave of launches over the next year or so in other markets where we're not launched already. Linked to that is profitability - we've done a very good job over the last couple of years since the merger of making the business profitable and the scale helps you do that. The third thing is really the content, ultimately - at the end of the day, it's the stories, it's the content. And I feel really positive about what we have coming up over the next couple of years to do that."

Cooke opened his keynote with some observations from a global perspective, noting that the so-called streaming wars have entered a new phase: "In the last four or five years there was a de-aggregation of services with this kind of perception that you could create a really niche product for different consumer groups, heavy content investment. That kind of phase of the war is over. What I would say is that it's turning more into a Cold War. People are kind of aligning, figuring out who they can work with, an acceptance that there is a need to come together more. A few things we have done ourselves - bringing together of HBO Max and Discovery+ internally, and that's one of the reasons that the merger happened; we've also announced that we're going to be bundling with Disney in the US and we're creating a sports joint venture in the US. I think the war as it was, which was all about heavy investment, de-aggregation, that phase is done, we're entering into a slightly different phase now."

Talking about the newly launched Max streaming service, which is available in 65 territories, 25 in Europe, Cooke noted that "the successes that I've seen over the last year are when those moments the company's really focused on one thing - the launch of Max is a good example of that because it literally has been all pieces of the company pulling in one direction - there's a kind of familiarity now and an acceptance that we're heading in that direction". The three main pillars of a successful streaming operation according to the exec are: "profitability - I think now, at least for us and our shareholders and the stock market generally; scale - one of the advantages we've got is that we're only in 50% of what we see as addressable markets, so I think there's a lot of headroom for us to go; the third sign of success is engagement on the platform - there are many ways to get your product out to consumers, whether direct to consumer or a lot of the time through partnerships, which are really, really important, but you need the engagement on the platform."

The WBD GM for CEE described the region's market as highly competitive. "There is a combination of the global platforms like ourselves that are obviously in or entering the markets. You have really strong local streaming players as well, individual markets, but more likely multi-territory markets. And frankly, the partners that we work with, they do a really, really good job at curating the content and the services for consumers. So, I think it's really, really competitive - I'm not sure that in the end that everyone will be able to survive... It's incumbent on people to figure out how they work together, because the content is all great on all the platforms - the problem is accessing it. At the moment, it's quite fragmented still. And again, that's why I quite like the work that the telcos in the market that we deal with, and they do a very good job of putting it all together. And I do think that is where things are going to start to head." As far as how many streaming services people need in CEE, Cooke said that it varies by country but WBD's ambition is to be in the Top 3. "There's probably room for three services or a combination of global and local. I also think that this whole concept of the streaming war and the way we compartmentalize is a bit lazy. The lines between what is an SVOD service, and then an AVOD service, and then a VOD for broadcast, BVOD service, and FAST channels - I think it's so complicated now, and it's all about getting the content to consumers in all the different ways that they want... I don't think we're at a settled point yet, it depends on markets, but some of the markets that I work in have major piracy issues. And so actually, in a way, you need more great streaming services so that you can convince people that it's worth paying for stuff, because at the moment they're able to get it for free. I don't know where the limit is, and I guess some of it, it's not a fixed thing either, because as individual economies grow, people have more free cash to spend."

In terms of linear TV and the HBO brand in CEE, Cooke said: "I talk about cash cows and there are different type of cash cows - you can choose to have a cow that's like nice and plump in a green field, or you can choose to have a very skinny cow in a desert somewhere. And so, the way I think about our traditional linear networks is in that way. I don't think you should accelerate their decline, there's so many different ways to consume content. You have to make balanced decisions market by market. We've made decisions that might seem counterintuitive. We launched a free-to-air channel in Czech Republic (Warner TV), in MENA. And actually, we see pretty solid growth on ad sales from linear channels. So, you could say, okay, well, that's a declining thing, you shouldn't put money into it. And we have these debates internally about the music industry. You could see what was happening with Spotify, and you have a choice to drive further into the decline, to come out quicker. I'm not sure that's the right approach for these markets, because there is still a big consumer habit to watch linear channels, even on streaming, and again, this is where the streaming and linear blurs. We acquired a streaming service in Turkey called BluTV and roughly 25% of the viewership on BluTV is on linear channels. They're paying subscribers, it's IP delivered on any device, but they're going in and watching linear broadcast... You have to treat that heritage (HBO) with the respect it deserves, and you have to balance the decision to maybe move away from linear channels faster than you need to, and I don't think we need to do that with the HBO linear channels. They do a fantastic job at getting consumers access to the content."

Cooke noted that there's a place for local content on Max: "If I go back to one of the key criteria for us, which is profitability, we had to make some tough decisions, and this was a topic at last year's conference, about shutting down our HBO scripted unit. And when you look at the impact that not having that content on the services had on profitability, on subscribers, it hasn't had a massive negative impact, negligible impact. So, I think that, on the other hand, there are other places where you can have a breakout hit and it does really, really well. I think there is definitely a role for local content, what I would look for is content that can travel. But there's a nuance there - you can end up with a very vanilla content if you try to go out with the premise that we're going to make something that's going to work in 50 countries. We have a group that actually looks at multi-market content creation - the process we have is it starts in a local market, and they say this is a great story for this market and then the team will go 'great, that will also work in other places'. And then we will top that up for co-production, expanding the rights - for example shows like Border Control Spain that does phenomenally well everywhere - it just came out of the Spanish team, it's something that we then develop further and can then spread. If you're approaching the local content from 'I'm making it for every market', you're going to fail. If you approach it from 'I'm making it for this local market and this local market only' I think that's fine, but that's not for us - that's the world of probably the free-to-air broadcasters. If you're making content that is really good in this market and it has a resonance that can go into other places, that can work anywhere in my mind. Yesterday with my team we talked about the 'Nasty' (a documentary about the ’70s Romanian tennis player Ilie Nastase, ed) which is about nostalgia, that kind of thing. It taps into a zeitgeist of a period of time, a known figure, sports. The BluTV platform we bought was pretty much fully based on local content. However, The Last of Us, that aired and premiered there, did just as well as their best performing local show. So, the question is not about one or the other, it's about how many you need of each, in my mind."

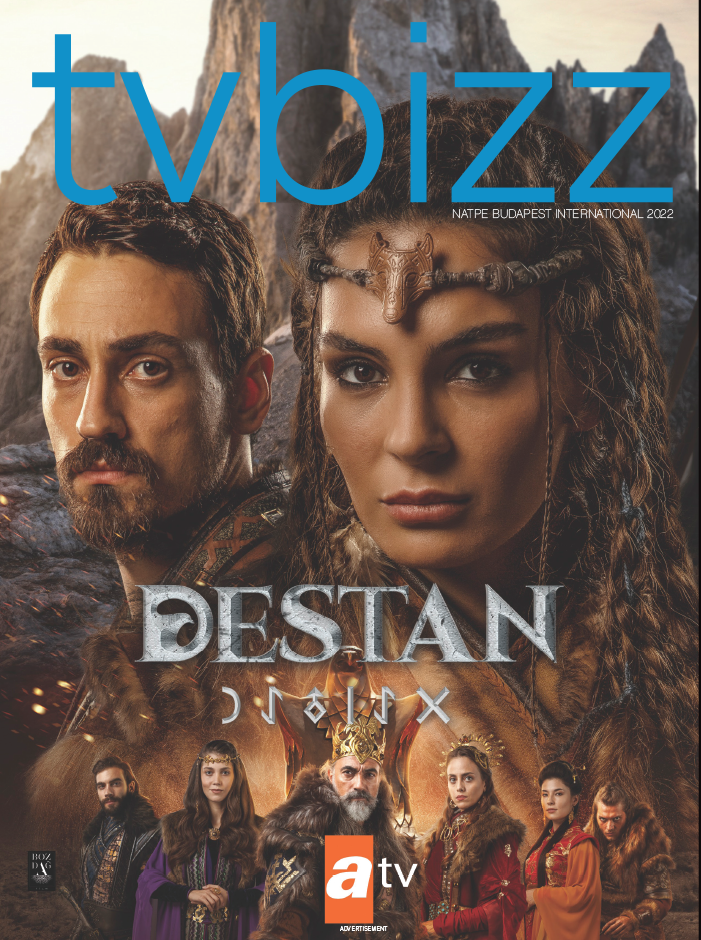

Talking specifically about the acquisition of BluTV in Turkey, the WBD exec once again underlined the three pillars for the company: "Profitability, scale, engagement - if you've got a choice to launch a product on your own in Turkey, a very difficult market to penetrate, very competitive, you could choose to do that and you could sink a load of cash into that and that may work. Or you can buy an established pipeline of content, a strong subscriber base - they have about 1.3, 1.4 million subscribers and a highly engaged audience around that content. So, it ticks all the boxes. We know that Turkish content works very well in this region, in Latin America. Interestingly, it's starting to work in Italy, where we've started to air on some free-to-air channels - I've got one eye on how we start to tap into that content to develop stuff that we can use and create Max globally, because we know that stuff works."

As far as what his strategy is of making Max one of the top 3 streamers in the region, Cooke said: "We have a lot of headroom to grow and that is going to really help us get to that top three global player because we've just launched in Europe, we have Asia to come and then we have potentially second wave of launches over the next year or so in other markets where we're not launched already. Linked to that is profitability - we've done a very good job over the last couple of years since the merger of making the business profitable and the scale helps you do that. The third thing is really the content, ultimately - at the end of the day, it's the stories, it's the content. And I feel really positive about what we have coming up over the next couple of years to do that."