The NFT boom – what it is and is the craze over now?

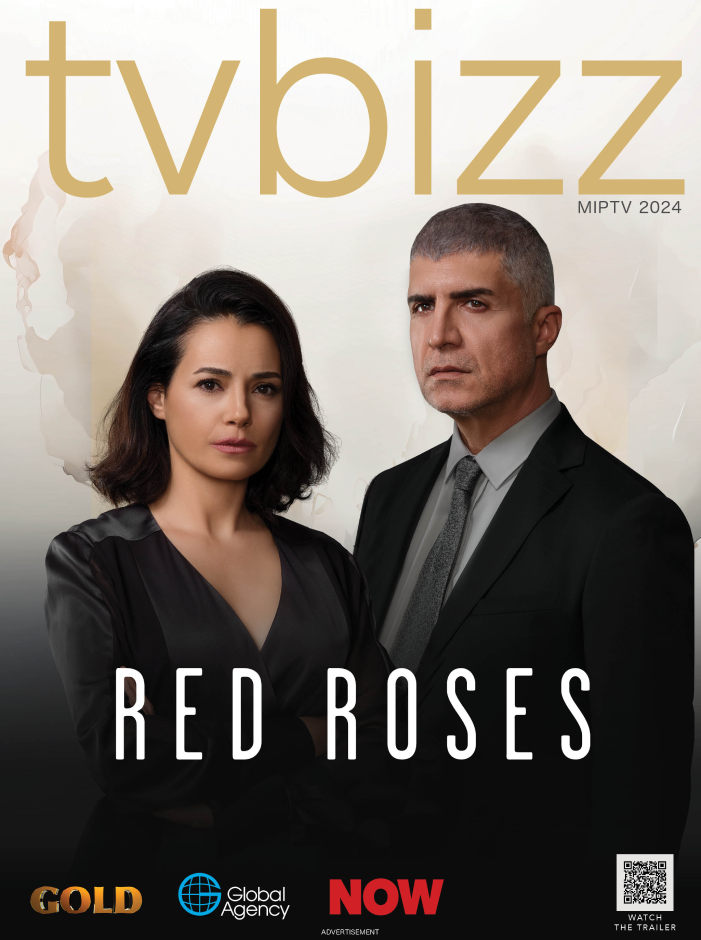

Non-fungible tokens (NFT) caused a furor in the art world earlier this year. In March, South Carolina-based graphic designer Beeple, whose real name is Mike Winkleman, sold NFT (his collage “Everydays”) for a record $69 million at Christie’s auction. Twitter CEO Jack Dorsey sold his first tweet as NFT for $2.9 million earlier that month. Recently, a rare digital avatar known as CryptoPunk was sold by Sotheby’s for over $11.8 million. NFT's total sales reached an impressive $2 billion in the first quarter of this year, according to Nonfungible, a market-monitoring website.

But new evidence shows that the euphoria surrounding NFT is waning. Total sales shrank from a seven-day peak of $176 million on May 9 to just $8.6 million on June 15, according to Nonfungible. This means that the volumes are now close to those we observed in early 2021.

But are NFTs worth the money—or the hype? Some experts say they’re a bubble poised to pop, like the dotcom craze or Beanie Babies. Others believe NFTs are here to stay, and that they will change investing forever, Forbes notes. https://www.forbes.com/advisor/investing/nft-non-fungible-token

Geoff Osler, CEO and co-founder of NFT app S!NG, said the digital collectibles craze was likely driven by “pent-up demand” from wealth accumulated from rising cryptocurrency prices, and that the market now seems to be calming in tandem with a drop in crypto markets.

NFT is a digital asset that represents real-world objects like art, music, in-game items and videos. They are bought and sold online, frequently with cryptocurrency, and they are generally encoded with the same underlying software as many cryptos. Although they’ve been around since 2014, NFTs are gaining notoriety now because they are becoming an increasingly popular way to buy and sell digital artwork.

NFTs are also generally one of a kind, or at least one of a very limited run, and have unique identifying codes. NFT is the missing piece of the digital art puzzle because it deals with several key issues in the context of the digital world that are essentially philosophical - the concept of ownership, value and uniqueness. Since the dawn of the Internet, these concepts have been blurred and artists suffer from it. Thanks to the clever contracts with which they are recorded in the blockchain network of Etherium, the irreplaceable tokens allow users to be the real owner of a work, while indirectly solving the case with the authenticity of the work. Hence the regular question "then what is the difference between buying an irreplaceable token and clicking with the mouse to download the same vision, video or song". The answer - NFT is designed to give its owner something unique that cannot be copied. This is the ownership of the work - physically anyone can buy a print of Van Gogh, but only one person can own the original of the work.

Blockchain technology and NFTs give artists and content creators a unique opportunity to monetize their wares. For example, artists no longer have to rely on galleries or auction houses to sell their art. Instead, the artist can sell it directly to the consumer as NFT, which also lets them keep more of the profits. In addition, artists can program in royalties so they will receive a percentage of sales whenever their art is sold to a new owner. This is an attractive feature as artists generally do not receive future proceeds after their art is first sold.

Media giants have also entered the NFT market. Recently FOX Entertainment and its Emmy Award-winning animation studio, Bento Box Entertainment, announced entry into the fast-growing market, including the launch of a business and creative unit, Blockchain Creative Labs. Blockchain Creative Labs will provide content creators, IP owners and advertising partners end-to-end blockchain computer ecosystem solutions to build, launch, manage and sell NFT content and experiences, and fungible tokens, as well as digital goods and assets. In addition, FOX Entertainment and Bento Box have formed a $100 million creator fund that will be managed by Blockchain Creative Labs to identify growth opportunities in the NFT space.

Based in Los Angeles, Blockchain Creative Labs will operate under the FOX Entertainment banner. Scott Greenberg, Co-Founder and CEO of Bento Box Entertainment, will serve as CEO of Blockchain Creative Labs and be responsible for overseeing the unit and the newly formed content fund. While assuming his new responsibilities, Greenberg will continue in his role at Bento Box and report to Collier.

At its Upfront presentation, FOX announced that Blockchain Creative Labs will launch a dedicated digital marketplace for Emmy Award-winning creator Dan Harmon's (Rick and Morty, Community) upcoming animated comedy, Krapopolis, marking the first animated series to be curated entirely on the blockchain. The company will manage and sell digital Krapopolis goods, including NFTs of one-of-a-kind character and background art and GIFs, as well as tokens that provide exclusive social experiences to engage and reward super fans.

Set in mythical ancient Greece and centered on a flawed family of humans, gods and monsters that tries to run one of the world's first cities without killing each other, Krapopolis is fully owned and financed by FOX Entertainment and will be produced by Bento Box.

Art isn’t the only way to make money with NFTs. Brands like Charmin and Taco Bell have auctioned off themed NFT art to raise funds for charity. Charmin dubbed its offering “NFTP” (non-fungible toilet paper), and Taco Bell’s NFT art sold out in minutes, with the highest bids coming in at 1.5 wrapped ether (WETH)—equal to $3,723.83 at time of writing.

Nyan Cat, a 2011-era GIF of a cat with a pop-tart body, sold for nearly $600.000 in February. NBA Top Shot generated more than $500 million in sales as of late March. A single LeBron James highlight NFT fetched more than $200,000. Even celebrities like Snoop Dogg and Lindsay Lohan are jumping on the NFT bandwagon, releasing unique memories, artwork and moments as securitized NFTs.

In other words, investing in NFTs is a largely personal decision. If you have money to spare, it may be worth considering, especially if a piece holds meaning for you. But keep in mind, an NFT’s value is based entirely on what someone else is willing to pay for it. Therefore, demand will drive the price rather than fundamental, technical or economic indicators, which typically influence stock prices and at least generally form the basis for investor demand.

All this means, an NFT may resale for less than you paid for it. Or you may not be able to resell it at all if no one wants it.

A day before his record-breaking auction, Beeple told the BBC: "I actually do think there will be a bubble, to be quite honest. And I think we could be in that bubble right now."

Many are even more skeptical. David Gerard, author of Attack of the 50-foot Blockchain, said he saw NFTs as buying "official collectables", similar to trading cards. "There are some artists absolutely making bank on this stuff... it's just that you probably won't," he warned. The people actually selling the NFTs are "crypto-grifters", he said. "The same guys who've always been at it, trying to come up with a new form of worthless magic bean that they can sell for money."

Nadya Ivanova, chief operating officer of research firm L’Atelier, which is affiliated with BNP Paribas, told CNBC, “The high-profile NFTs, which sell for millions of dollars, are speculative in the market. It was a sure sign that we were treating it as an asset. And by definition, the market for speculative assets is volatile and tends to be depleted.”

“The bigger problem with NFTs is the long-term value of NFTs, and we believe this is probably important,” Ivanova added. “As augmented reality and virtual reality technologies mature, ordinary people spend more and more time, or money, in virtual environments.”

The NFT phenomenon has some issues to resolve before it becomes a widespread method of proving ownership of art and other original content, though. Copyright is a big one. A number of artists and content creators have complained their work is being stolen and sold on as NFTs online, CNBC notes. Some suggest NFTs might soothe long-running tensions between creators and tech platforms—while others point out the trend has already given rise to new forms of piracy and rip-offs.

Like everything else on the Internet that makes money, the NFT craze has attracted parasitic bad actors looking to cash in on the works of others. That's what happened to an artist who creates digital pictures under the name Weird Undead. She discovered someone has been stealing her images and selling them as NFTs, Decrypt notes (https://decrypt.co/60394/nft-craze-easy-money-hard-copyright-questions). Influential figures in the cryptocurrency industry, including Meltem Demirors of CoinShares and Neeraj Agrawal of Coin Center, have complained of random people repackaging their tweets as tokens for sale.

Not everyone is on board with NFTs, or the crypto-currency ecosystem because of its non-eco friendly nature as well. Some, who are just becoming aware of the format, are joining environmentalists and others who criticize the cryptoworld’s energy-consuming mining process. One of the biggest criticisms of the cryptocurrency world is its reliance on a proof-of-work model. Earlier this month, Tesla’s Musk joined the vocal critics, calling on the industry to move away from the model -that uses a ton of fossil fuels.

This spring, as NFTs gained a huge following, it also brought more people to consider the concerns about the carbon footprint from NFTs processing.

But new evidence shows that the euphoria surrounding NFT is waning. Total sales shrank from a seven-day peak of $176 million on May 9 to just $8.6 million on June 15, according to Nonfungible. This means that the volumes are now close to those we observed in early 2021.

But are NFTs worth the money—or the hype? Some experts say they’re a bubble poised to pop, like the dotcom craze or Beanie Babies. Others believe NFTs are here to stay, and that they will change investing forever, Forbes notes. https://www.forbes.com/advisor/investing/nft-non-fungible-token

Geoff Osler, CEO and co-founder of NFT app S!NG, said the digital collectibles craze was likely driven by “pent-up demand” from wealth accumulated from rising cryptocurrency prices, and that the market now seems to be calming in tandem with a drop in crypto markets.

NFT is a digital asset that represents real-world objects like art, music, in-game items and videos. They are bought and sold online, frequently with cryptocurrency, and they are generally encoded with the same underlying software as many cryptos. Although they’ve been around since 2014, NFTs are gaining notoriety now because they are becoming an increasingly popular way to buy and sell digital artwork.

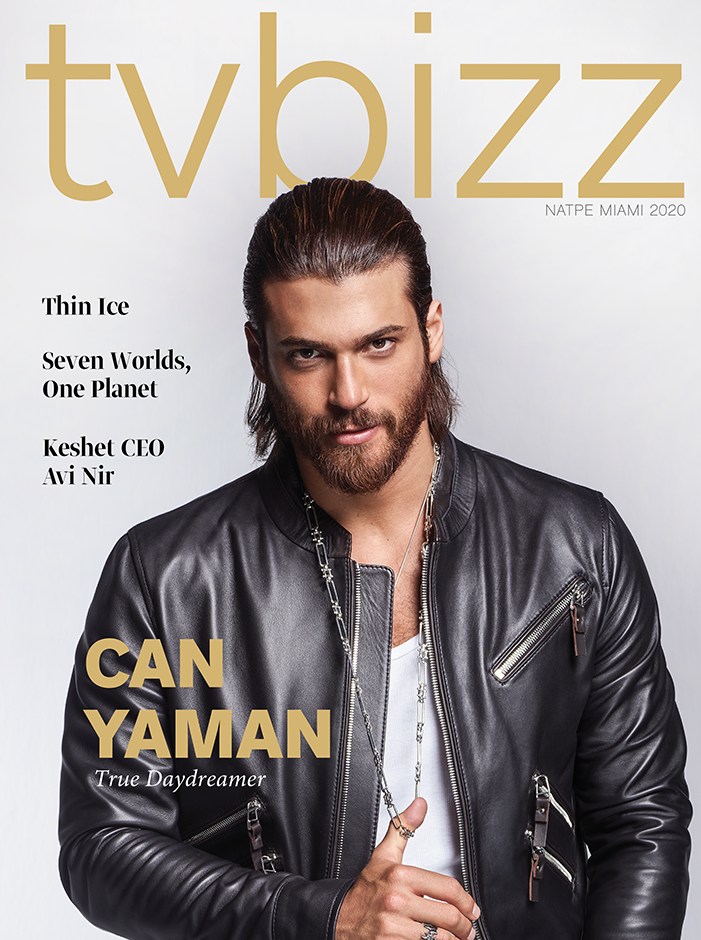

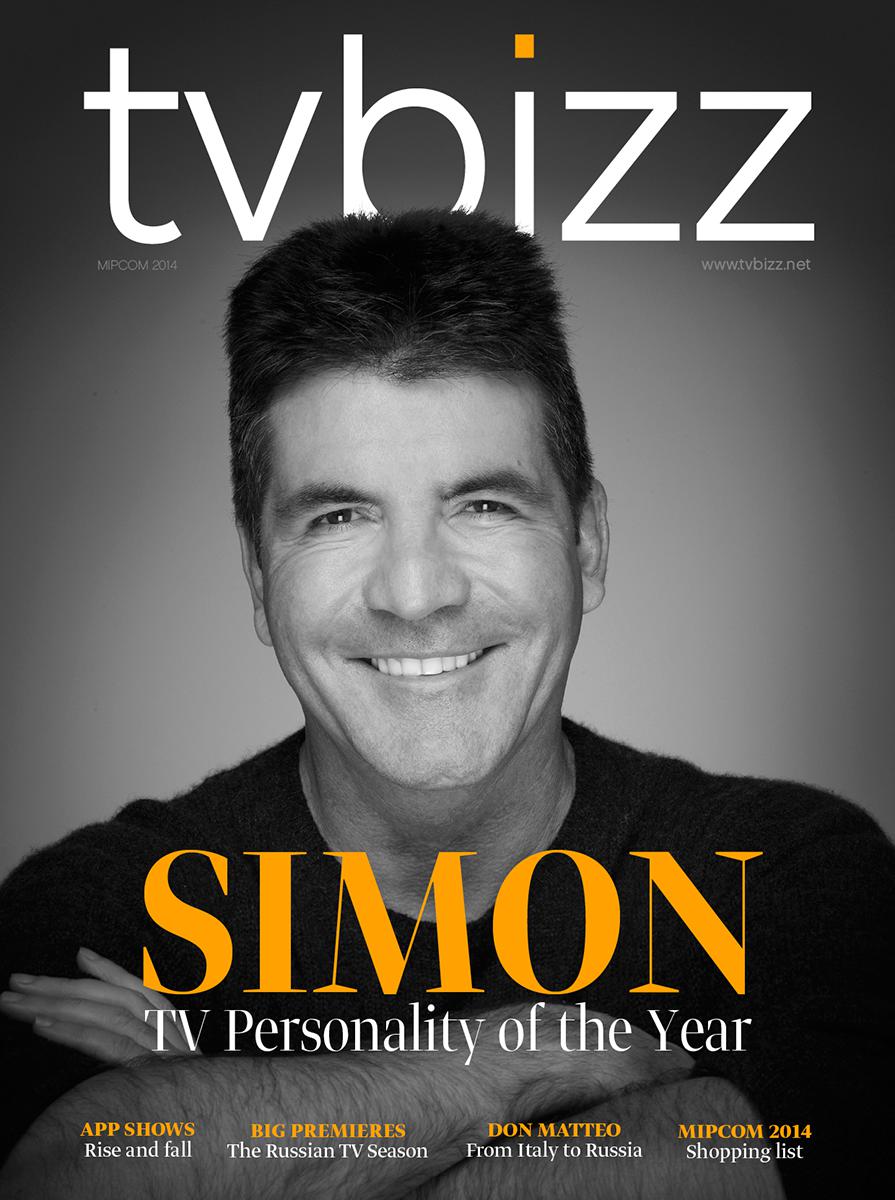

Crypto Punk

NFTs are also generally one of a kind, or at least one of a very limited run, and have unique identifying codes. NFT is the missing piece of the digital art puzzle because it deals with several key issues in the context of the digital world that are essentially philosophical - the concept of ownership, value and uniqueness. Since the dawn of the Internet, these concepts have been blurred and artists suffer from it. Thanks to the clever contracts with which they are recorded in the blockchain network of Etherium, the irreplaceable tokens allow users to be the real owner of a work, while indirectly solving the case with the authenticity of the work. Hence the regular question "then what is the difference between buying an irreplaceable token and clicking with the mouse to download the same vision, video or song". The answer - NFT is designed to give its owner something unique that cannot be copied. This is the ownership of the work - physically anyone can buy a print of Van Gogh, but only one person can own the original of the work.

Blockchain technology and NFTs give artists and content creators a unique opportunity to monetize their wares. For example, artists no longer have to rely on galleries or auction houses to sell their art. Instead, the artist can sell it directly to the consumer as NFT, which also lets them keep more of the profits. In addition, artists can program in royalties so they will receive a percentage of sales whenever their art is sold to a new owner. This is an attractive feature as artists generally do not receive future proceeds after their art is first sold.

Media giants have also entered the NFT market. Recently FOX Entertainment and its Emmy Award-winning animation studio, Bento Box Entertainment, announced entry into the fast-growing market, including the launch of a business and creative unit, Blockchain Creative Labs. Blockchain Creative Labs will provide content creators, IP owners and advertising partners end-to-end blockchain computer ecosystem solutions to build, launch, manage and sell NFT content and experiences, and fungible tokens, as well as digital goods and assets. In addition, FOX Entertainment and Bento Box have formed a $100 million creator fund that will be managed by Blockchain Creative Labs to identify growth opportunities in the NFT space.

Based in Los Angeles, Blockchain Creative Labs will operate under the FOX Entertainment banner. Scott Greenberg, Co-Founder and CEO of Bento Box Entertainment, will serve as CEO of Blockchain Creative Labs and be responsible for overseeing the unit and the newly formed content fund. While assuming his new responsibilities, Greenberg will continue in his role at Bento Box and report to Collier.

At its Upfront presentation, FOX announced that Blockchain Creative Labs will launch a dedicated digital marketplace for Emmy Award-winning creator Dan Harmon's (Rick and Morty, Community) upcoming animated comedy, Krapopolis, marking the first animated series to be curated entirely on the blockchain. The company will manage and sell digital Krapopolis goods, including NFTs of one-of-a-kind character and background art and GIFs, as well as tokens that provide exclusive social experiences to engage and reward super fans.

Set in mythical ancient Greece and centered on a flawed family of humans, gods and monsters that tries to run one of the world's first cities without killing each other, Krapopolis is fully owned and financed by FOX Entertainment and will be produced by Bento Box.

Art isn’t the only way to make money with NFTs. Brands like Charmin and Taco Bell have auctioned off themed NFT art to raise funds for charity. Charmin dubbed its offering “NFTP” (non-fungible toilet paper), and Taco Bell’s NFT art sold out in minutes, with the highest bids coming in at 1.5 wrapped ether (WETH)—equal to $3,723.83 at time of writing.

Nyan Cat, a 2011-era GIF of a cat with a pop-tart body, sold for nearly $600.000 in February. NBA Top Shot generated more than $500 million in sales as of late March. A single LeBron James highlight NFT fetched more than $200,000. Even celebrities like Snoop Dogg and Lindsay Lohan are jumping on the NFT bandwagon, releasing unique memories, artwork and moments as securitized NFTs.

In other words, investing in NFTs is a largely personal decision. If you have money to spare, it may be worth considering, especially if a piece holds meaning for you. But keep in mind, an NFT’s value is based entirely on what someone else is willing to pay for it. Therefore, demand will drive the price rather than fundamental, technical or economic indicators, which typically influence stock prices and at least generally form the basis for investor demand.

All this means, an NFT may resale for less than you paid for it. Or you may not be able to resell it at all if no one wants it.

A day before his record-breaking auction, Beeple told the BBC: "I actually do think there will be a bubble, to be quite honest. And I think we could be in that bubble right now."

Many are even more skeptical. David Gerard, author of Attack of the 50-foot Blockchain, said he saw NFTs as buying "official collectables", similar to trading cards. "There are some artists absolutely making bank on this stuff... it's just that you probably won't," he warned. The people actually selling the NFTs are "crypto-grifters", he said. "The same guys who've always been at it, trying to come up with a new form of worthless magic bean that they can sell for money."

Nadya Ivanova, chief operating officer of research firm L’Atelier, which is affiliated with BNP Paribas, told CNBC, “The high-profile NFTs, which sell for millions of dollars, are speculative in the market. It was a sure sign that we were treating it as an asset. And by definition, the market for speculative assets is volatile and tends to be depleted.”

“The bigger problem with NFTs is the long-term value of NFTs, and we believe this is probably important,” Ivanova added. “As augmented reality and virtual reality technologies mature, ordinary people spend more and more time, or money, in virtual environments.”

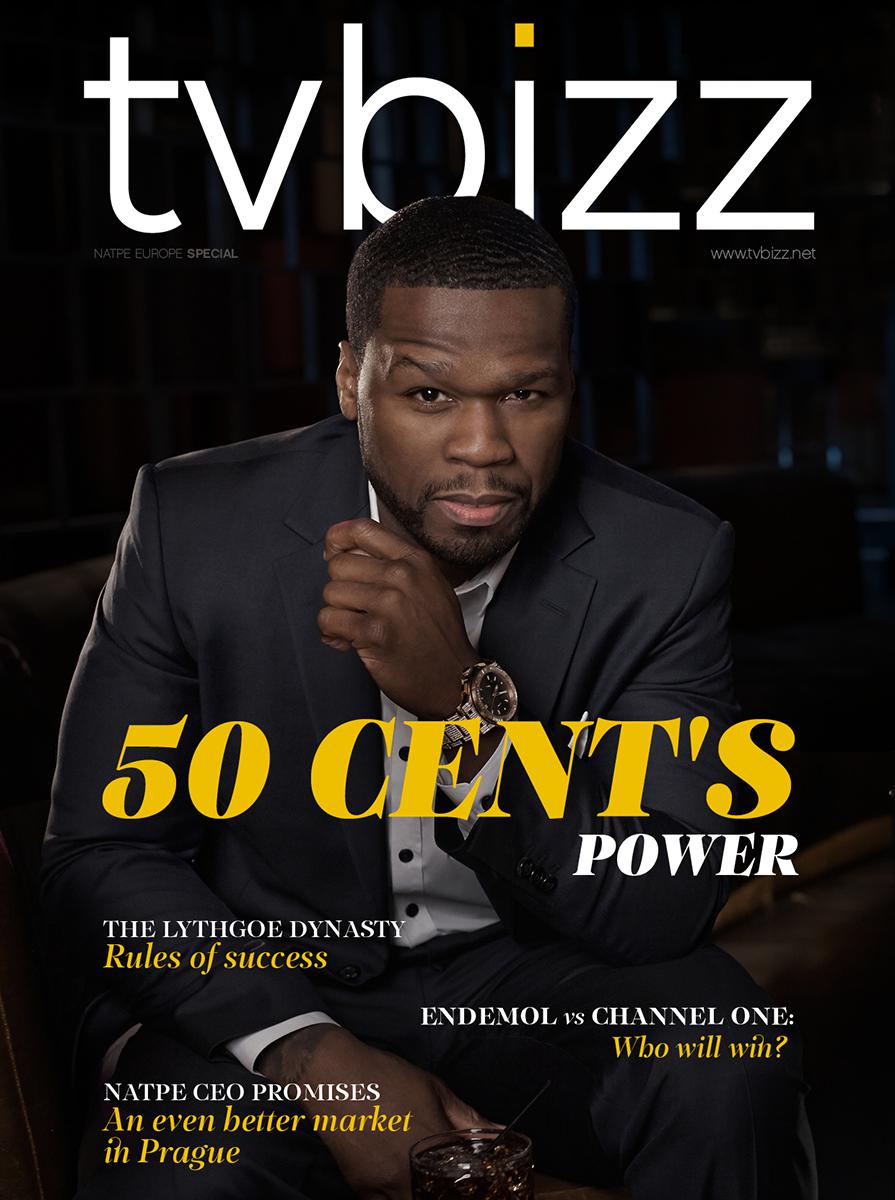

Nyan Cat

The NFT phenomenon has some issues to resolve before it becomes a widespread method of proving ownership of art and other original content, though. Copyright is a big one. A number of artists and content creators have complained their work is being stolen and sold on as NFTs online, CNBC notes. Some suggest NFTs might soothe long-running tensions between creators and tech platforms—while others point out the trend has already given rise to new forms of piracy and rip-offs.

Like everything else on the Internet that makes money, the NFT craze has attracted parasitic bad actors looking to cash in on the works of others. That's what happened to an artist who creates digital pictures under the name Weird Undead. She discovered someone has been stealing her images and selling them as NFTs, Decrypt notes (https://decrypt.co/60394/nft-craze-easy-money-hard-copyright-questions). Influential figures in the cryptocurrency industry, including Meltem Demirors of CoinShares and Neeraj Agrawal of Coin Center, have complained of random people repackaging their tweets as tokens for sale.

Not everyone is on board with NFTs, or the crypto-currency ecosystem because of its non-eco friendly nature as well. Some, who are just becoming aware of the format, are joining environmentalists and others who criticize the cryptoworld’s energy-consuming mining process. One of the biggest criticisms of the cryptocurrency world is its reliance on a proof-of-work model. Earlier this month, Tesla’s Musk joined the vocal critics, calling on the industry to move away from the model -that uses a ton of fossil fuels.

This spring, as NFTs gained a huge following, it also brought more people to consider the concerns about the carbon footprint from NFTs processing.