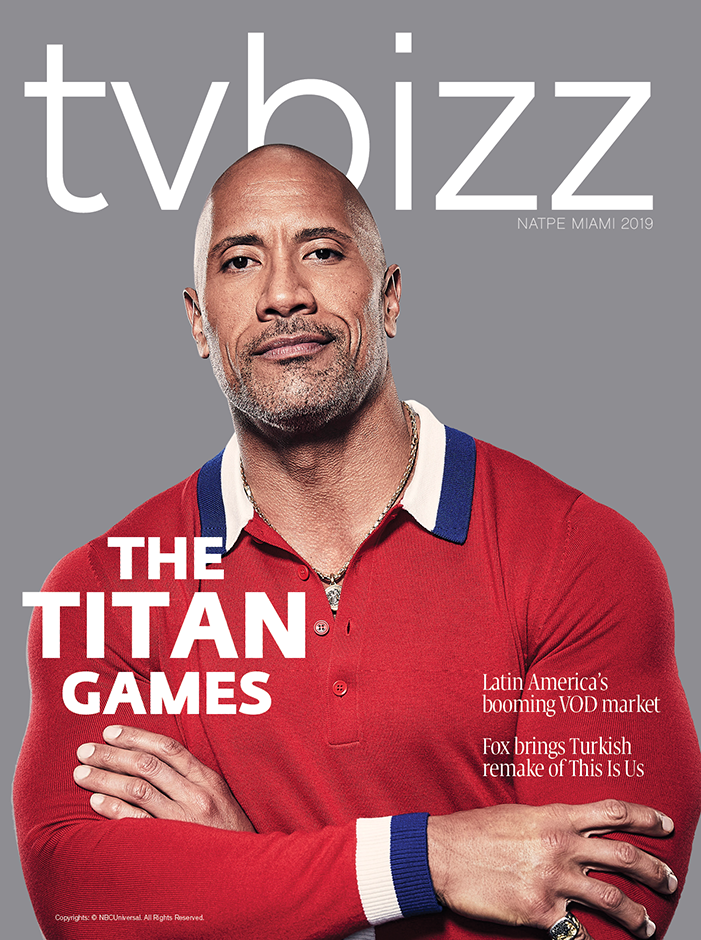

Latin America’s booming VOD market

The VOD market in Latin America is evolving fast with more players and new content expected to heat up the competition this year and further increase consumption to reach new record levels. Yako Molhov and Alejandro Rojas, Regional Director at Parrot Analytics for Latin America, tried to outline the key trends and main preferences of the users as well as the factors that will drive the continued growth for VOD services in the region.

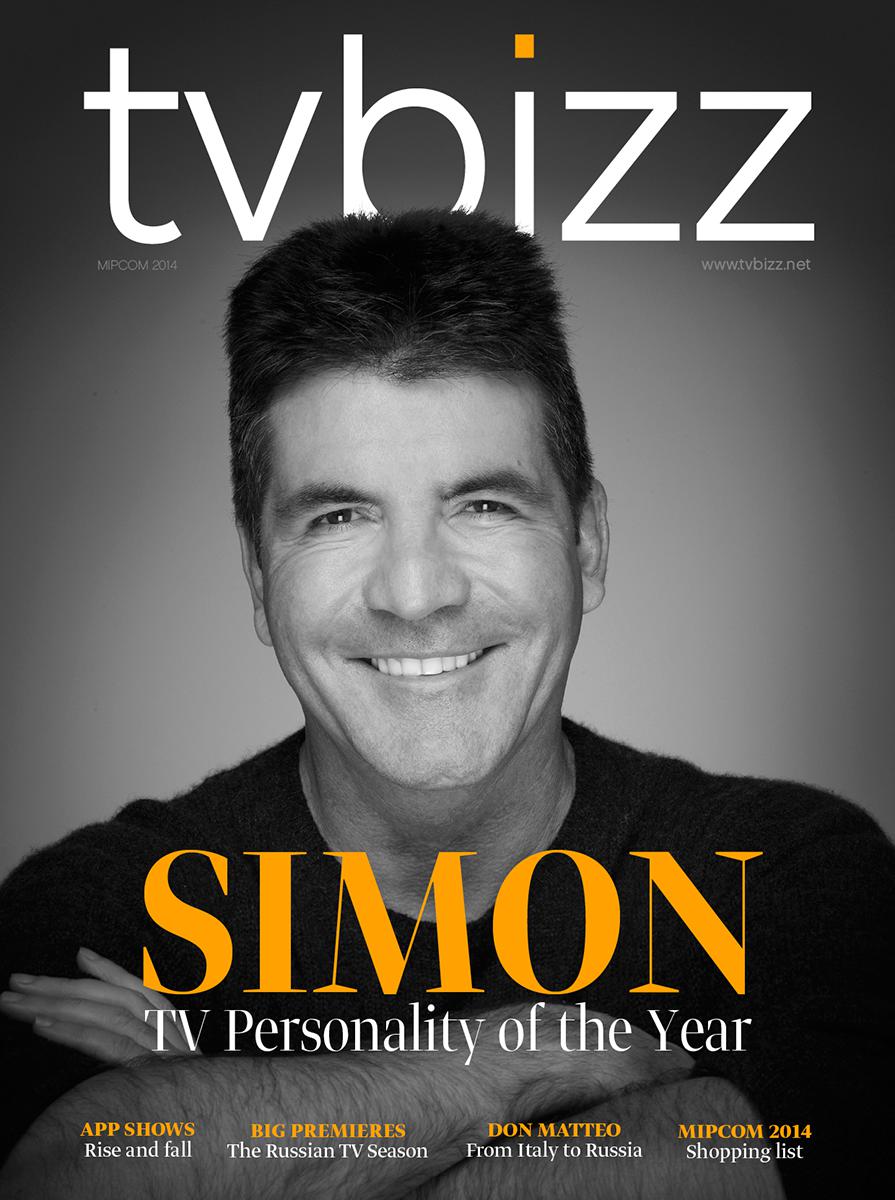

Alejandro Rojas, Regional Director at Parrot Analytics for Latin America

What was the most popular content on demand in Latin America in 2018 based on your research? What are the most popular genres and titles?

On one hand, we have the international blockbusters – a category where apocalyptic dramas like The Walking Dead and fantasy dramas like Game of Thrones top the charts – this is what we see on the international side. If we take a look at the regional content, it is a different story – we have more drama, including a lot of crime drama which is highly popular in Latin America and then we observe more local content such as variety and reality shows, offering a mixture for all tastes. What we have noticed this year is an increasing demand for comedy as opposed to previous years – in 2018 we saw a peak in comedy content. For example, shows like La Casa de las Flores did very well in Latin America. Of course, drama keeps being the most important genre and crime drama is definitely one of the top genres in the region but now also comedy is on the rise.

There are also some other opportunities: children content is getting a lot of demand, especially from local productions. There are shows like Soy Luna from Argentina which airs in Latin America and was one of the most popular shows across the region. We also we have a Brazilian show called Galinha Pintadinha which is very popular not only in Brazil but all over the world. It is a good example of the different type of content that could travel across the world, coming from Latin America. In Brazil, there are also shows like Porta dos Fundos which originated as a comedy YouTube channel and it is doing really well.

Of course, there are differences across the region. If you compare Argentina to Colombia for example, in Argentina people would watch more food reality shows as opposed to fashion and beauty shows which are popular in Colombia.

What are the latest VOD trends in Latin America? How is the region different from other international markets?

We did an analysis recently – if you take the Top 100 shows that air on linear TV and if you compare them with the top 100 shows aired on digital platforms, there is 75%-25% relationship, linear TV content is still significant but not as dominant as it was a year, or two years ago. This is happening everywhere but in Latin America it is happening very quickly.

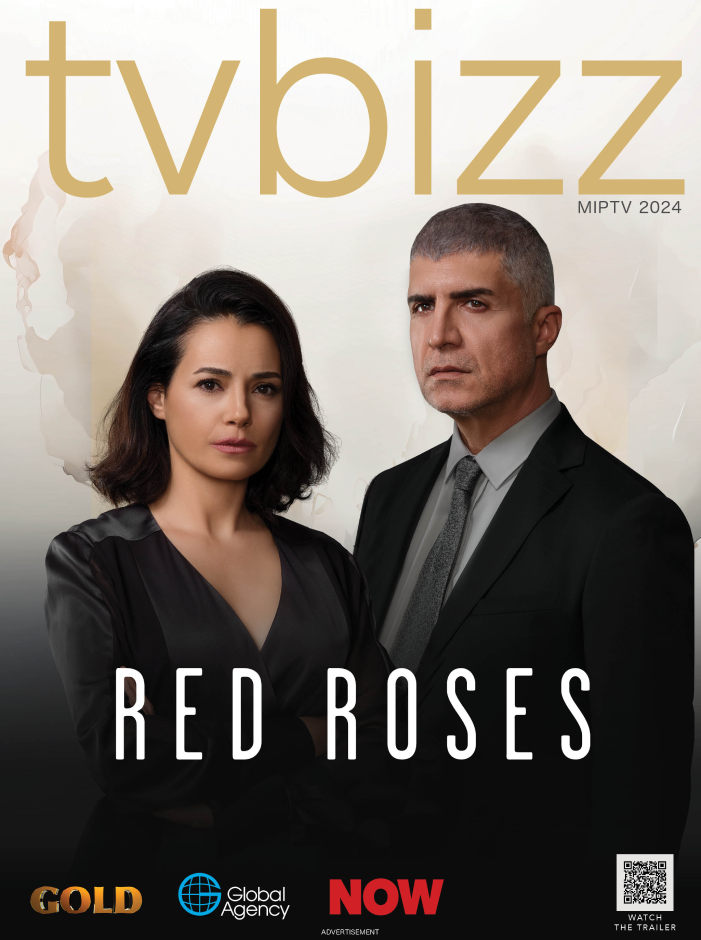

Another thing different in Latin America is that a big portion of the shows are regional shows. In Brazil, you have a show called O Mecanismo which was based on the Lava Jato corruption case (Operation Car Wash) which was an amazing hit in Brazil but also did reasonably well in international markets. In Mexico, we see that more local shows are airing only on digital platforms. Mexico is producing more local content for digital platforms if you compare to three years ago when the offering was limited to Ingobernable and Club De Cuervos, the two main shows on the top of the list. They are still near the top of the list but now you also have La Casa de las Flores and Luis Miguel so the offering is getting wider. More shows are introduced thinking about regional, local audiences and these are growing at a faster clip than other regions, i.e. regional shows on digital platforms are doing really, really well.

Where is Latin American produced content most popular outside of the region?

Obviously, the top market would be Spain, some of the shows like La Casa de las Flores are in high demand in Spain, which is a natural market for Latin American content. The Spanish series La Casa de Papel has become very popular in other territories like Turkey, France, Germany, almost everywhere. This show has opened doors for Spanish-language content to enter new territories. When you think of Latin American content you think mostly of telenovelas but this is changing, even the format of telenovelas is changing, becoming shorter, more engaging and with a higher production value. The stories might be the same but there are changes in the way the stories are told.

What are the latest trends in the on-demand market in Latin America in terms of players? Are big players like Netflix, Hulu, Amazon more popular than regional players?

Netflix performs really well in the region. They combine big international shows with local shows which is very attractive. Amazon, in a way, is also gaining ground, they are trying to become more global than Netflix, to introduce more local content, they are introducing interesting content in Mexico, for example. They partner with really established players like Televisa. in Mexico they have a partnership and they are trying to create content that appeals to the local markets. 2019 will be interesting: Netflix shows are still leading the charts, but this might change, there will be increased competition. There are opportunities for everyone, so marketing becomes even more important. Lots of local shows are of high quality but lack a robust marketing strategy. Netflix is very strong with marketing, they are taking into account everything the consumer is doing. A lot of other players are also moving in this direction, trying to use data to market shows and even to create new shows. We have been involved in many projects, our data has been used to understand what kind of content to be created and how this content should be marketed. There will be a lot of changes in this regard. The better you understand the market, the better you will be positioned to capture this opportunity.

How important is it whether the series are dubbed or subtitled in the region?

Latin America, as opposed to Europe where, for example in Spain and Italy they usually prefer dubbed content, most people are used to subtitles so this is an option they don’t mind. Now, more than ever, Latin American viewers are open to content coming from other regions. For example, from the US or the UK but also from Italy and Spain, even shows like Dark from Germany are gaining audiences. Latin America is a great market in that sense because viewers are almost “trained” to watch content with subtitles and audiences are open to content from other markets. For example, La Casa de Papel actually had higher demand in Brazil than in Spain. This is a signal of how global forces will be affecting local markets in Latin America. I would expect this trend to continue growing so local players will have to fight for their local audiences.

On one hand, we have the international blockbusters – a category where apocalyptic dramas like The Walking Dead and fantasy dramas like Game of Thrones top the charts – this is what we see on the international side. If we take a look at the regional content, it is a different story – we have more drama, including a lot of crime drama which is highly popular in Latin America and then we observe more local content such as variety and reality shows, offering a mixture for all tastes. What we have noticed this year is an increasing demand for comedy as opposed to previous years – in 2018 we saw a peak in comedy content. For example, shows like La Casa de las Flores did very well in Latin America. Of course, drama keeps being the most important genre and crime drama is definitely one of the top genres in the region but now also comedy is on the rise.

There are also some other opportunities: children content is getting a lot of demand, especially from local productions. There are shows like Soy Luna from Argentina which airs in Latin America and was one of the most popular shows across the region. We also we have a Brazilian show called Galinha Pintadinha which is very popular not only in Brazil but all over the world. It is a good example of the different type of content that could travel across the world, coming from Latin America. In Brazil, there are also shows like Porta dos Fundos which originated as a comedy YouTube channel and it is doing really well.

Of course, there are differences across the region. If you compare Argentina to Colombia for example, in Argentina people would watch more food reality shows as opposed to fashion and beauty shows which are popular in Colombia.

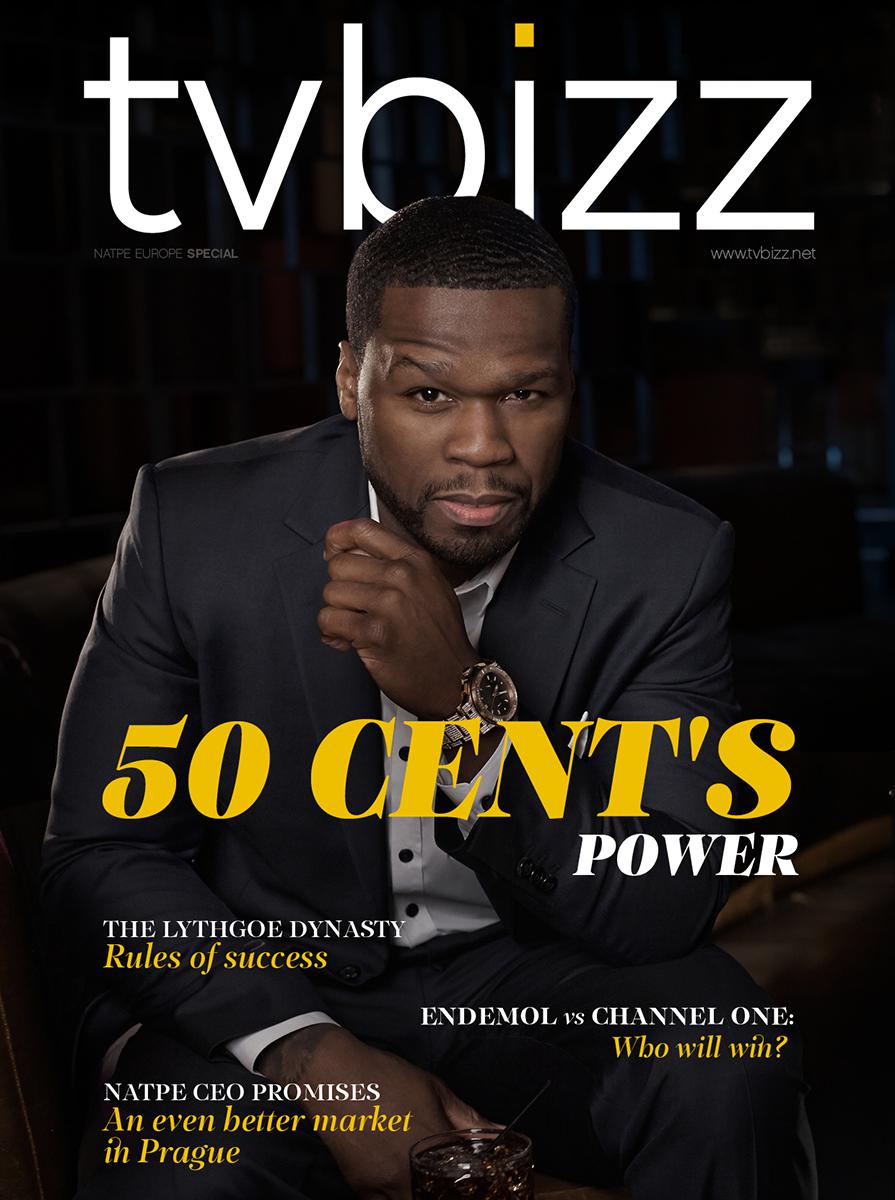

Club De Cuervos

What are the latest VOD trends in Latin America? How is the region different from other international markets?

We did an analysis recently – if you take the Top 100 shows that air on linear TV and if you compare them with the top 100 shows aired on digital platforms, there is 75%-25% relationship, linear TV content is still significant but not as dominant as it was a year, or two years ago. This is happening everywhere but in Latin America it is happening very quickly.

Another thing different in Latin America is that a big portion of the shows are regional shows. In Brazil, you have a show called O Mecanismo which was based on the Lava Jato corruption case (Operation Car Wash) which was an amazing hit in Brazil but also did reasonably well in international markets. In Mexico, we see that more local shows are airing only on digital platforms. Mexico is producing more local content for digital platforms if you compare to three years ago when the offering was limited to Ingobernable and Club De Cuervos, the two main shows on the top of the list. They are still near the top of the list but now you also have La Casa de las Flores and Luis Miguel so the offering is getting wider. More shows are introduced thinking about regional, local audiences and these are growing at a faster clip than other regions, i.e. regional shows on digital platforms are doing really, really well.

Where is Latin American produced content most popular outside of the region?

Obviously, the top market would be Spain, some of the shows like La Casa de las Flores are in high demand in Spain, which is a natural market for Latin American content. The Spanish series La Casa de Papel has become very popular in other territories like Turkey, France, Germany, almost everywhere. This show has opened doors for Spanish-language content to enter new territories. When you think of Latin American content you think mostly of telenovelas but this is changing, even the format of telenovelas is changing, becoming shorter, more engaging and with a higher production value. The stories might be the same but there are changes in the way the stories are told.

O Mecanismo

What are the latest trends in the on-demand market in Latin America in terms of players? Are big players like Netflix, Hulu, Amazon more popular than regional players?

Netflix performs really well in the region. They combine big international shows with local shows which is very attractive. Amazon, in a way, is also gaining ground, they are trying to become more global than Netflix, to introduce more local content, they are introducing interesting content in Mexico, for example. They partner with really established players like Televisa. in Mexico they have a partnership and they are trying to create content that appeals to the local markets. 2019 will be interesting: Netflix shows are still leading the charts, but this might change, there will be increased competition. There are opportunities for everyone, so marketing becomes even more important. Lots of local shows are of high quality but lack a robust marketing strategy. Netflix is very strong with marketing, they are taking into account everything the consumer is doing. A lot of other players are also moving in this direction, trying to use data to market shows and even to create new shows. We have been involved in many projects, our data has been used to understand what kind of content to be created and how this content should be marketed. There will be a lot of changes in this regard. The better you understand the market, the better you will be positioned to capture this opportunity.

How important is it whether the series are dubbed or subtitled in the region?

Latin America, as opposed to Europe where, for example in Spain and Italy they usually prefer dubbed content, most people are used to subtitles so this is an option they don’t mind. Now, more than ever, Latin American viewers are open to content coming from other regions. For example, from the US or the UK but also from Italy and Spain, even shows like Dark from Germany are gaining audiences. Latin America is a great market in that sense because viewers are almost “trained” to watch content with subtitles and audiences are open to content from other markets. For example, La Casa de Papel actually had higher demand in Brazil than in Spain. This is a signal of how global forces will be affecting local markets in Latin America. I would expect this trend to continue growing so local players will have to fight for their local audiences.

La Casa de las Flores