Are the ‘Streaming Wars’ Over or Have They Entered a New Phase?

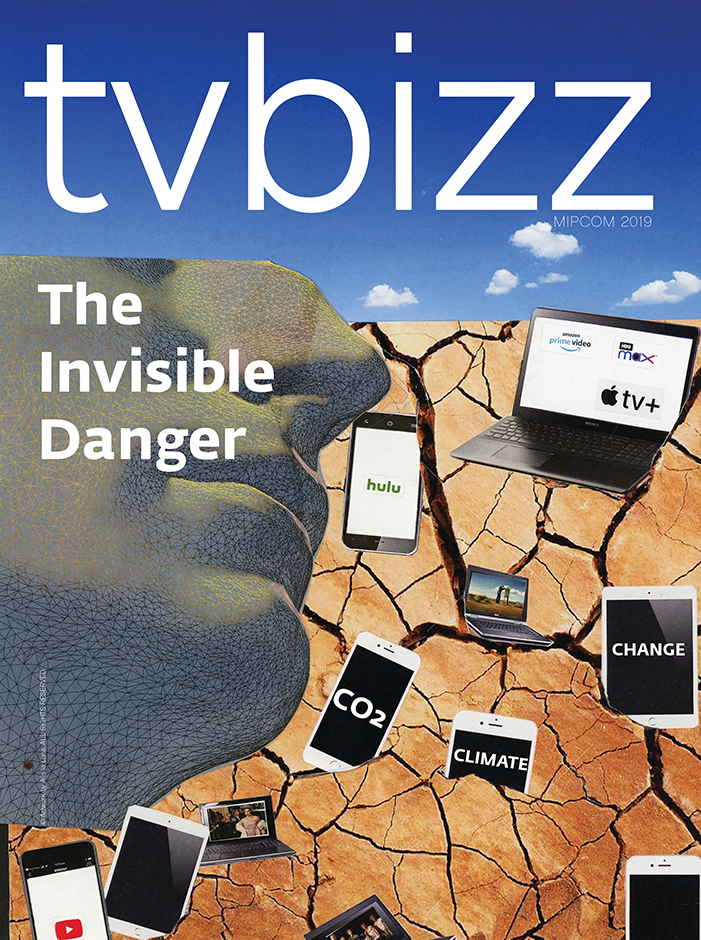

Describing what has been happening in the world of streaming as ‘wars’ seems inappropriate. Not only because of the real wars raging right now – with Russia’s invasion of Ukraine and Hamas’ latest attack on Israel which declared a state of war – but also because one can hardly talk about wars between streamers now and who will prevail over the other – it is more about surviving in the long term. One thing is sure, though – the ‘Golden Age’ of streaming is over.

Once there was much joy and excitement by the public for all the new streaming players appearing – HBO Max, Apple TV+, Peacock, Disney+; etc. The big companies that own them invested billions into content, offered cheap rates and promotions, first-run movies and just about anything else in order to compete with established players like Netflix – and they failed since the service continues to be on top by a large margin. Nowadays, it is all about ad tiers, password cracking, increasing prices, cutting costs (canceling shows) and mostly – getting back the billions invested up to this moment. Consumers will continue to prioritize which streaming services they maintain and which they let go. This creates a competitive landscape where streaming platforms vie to be the “chosen ones.”

There were several major developments in the past few months: Increasing prices – the latest news is about Netflix once again considering raising subscription prices, this time for its ad-tier (WSJ broke the news). The standard ad-free Netflix experience currently costs users $15.49 per month and is one of three options available to viewers since the service dropped its cheapest ad-free option in July—there’s also a $6.99 ad-supported plan and $19.99 “premium” plan with Ultra HD. Discovery+ owner Warner Bros. Discovery said it will also raise the monthly price of its ad-free tier by $2 for a total monthly cost of $8.99—viewers can see ads on the platform and pay $4.99 (Warner Bros. Discovery also owns pricier streaming service Max). Netflix and Discovery+ join (HBO) Max, Peacock, Paramount+, Starz and AMC Networks-owned Shudder in raising their prices so far this year. Netflix last raised its rate in the first half of 2022, with its most popular plan getting a $1.50 increase. Amazon, which bundles its Prime Video service with its Prime membership program, raised its annual fee by $20 to $139. YouTube TV raised its prices in March, and Hulu With Live TV will join it in October.

The password cracking continues: when Netflix started the password sharing crackdown, many people expected this to be failure. Now many other streamers are following in its footsteps. In fact Disney+ announced that it will begin the process in November. “The cancel reaction was low and while we’re still in the early stages of monetization, we’re seeing healthy conversion of borrower households into full-paying Netflix memberships as well as the uptake of our extra member feature,” Netflix said in its second-quarter investor letter. And it added a net 5.9 million subscribers in the period, a dramatic reversal from the 1.8 million it added in the first quarter.

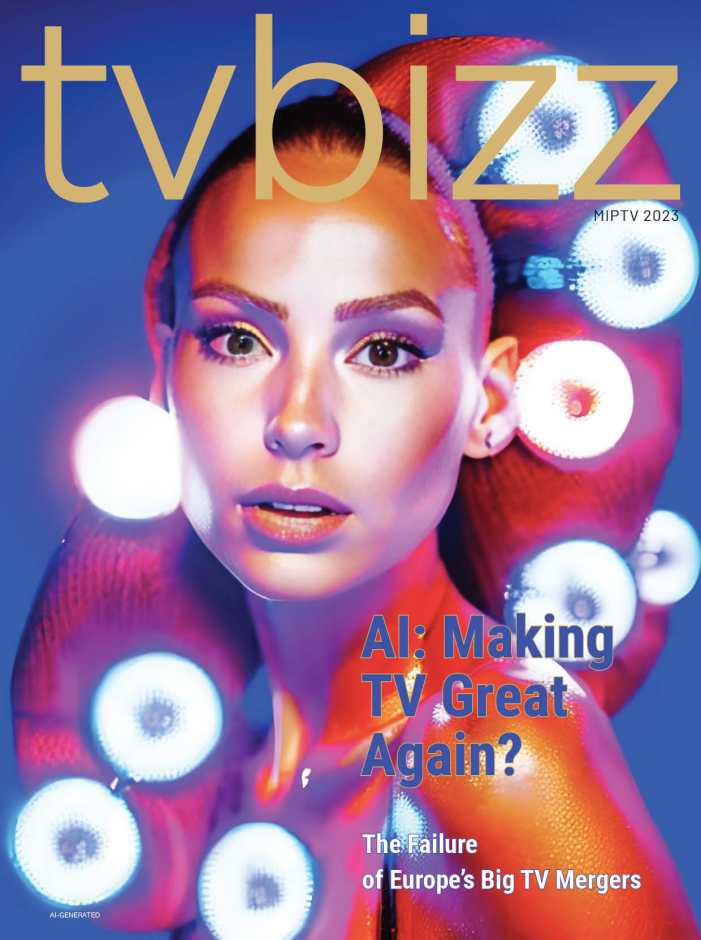

Ad tiers enter the scene: Netflix, as well as Max and Disney+, have raised rates in recent months and launched cheaper ad-based subscription options for customers, trying to boost revenue in a challenging era and remain competitive with more price-sensitive customers. Netflix too has gone all-in on a lower-cost, ad-supported service, something that its co-founder and now chairman Reed Hastings said for years the company would never do – which says a lot. Most recently, Amazon announced that it plans to introduce “limited” advertising on Prime Video movies and shows, beginning early next year. The company’s release said the U.S., U.K., Germany and Canada will be the first countries to get Prime Video ads, though Amazon didn’t specify the timing beyond “early 2024.” France, Italy, Spain, Mexico, and Australia are set to introduce Prime Video ads later in the year. Most of the major streamers now have some kind of ad-supported tier. Dataxis reported that the 9 territories selected for the launch of advertising in 2024 on Prime Video, Germany, Canada, the US, and later this year the UK, followed by Australia, Spain, France, Italy and Mexico count in total nearly 160 million subscribers, 180 million counting the 22 million from the service in India where Amazon launched a tier with ads in June. As a comparison, the 12 countries in which Netflix’s ad-supported offer is currently available represent a potential audience of around 170 million subscribers. Netflix and Disney+ in late 2022 both introduced lower-cost plans with ads. Prior to that, services like Hulu, HBO Max (now Max) and Paramount+ already offered ad-supported options. Amazon also has a separate free ad-supported streaming TV (FAST) service, Freevee, which users can access through Prime Video or via a standalone app, if they aren’t subscribed to Prime. Apple TV+ is one of the last big-name streamers that’s completely ad-free. But that may change in the future, as Apple in February hired Lauren Fry as head of video ad sales, The Information reported.

Sports becomes even more important: the future of sports belongs to streamers and most likely vice versa. Naturally, the battle for rights is heating up as Apple, Amazon, YouTube, and Peacock try to make their own “ESPN”. Some experts think Apple should buy it, others believe Apple can build it on its own, as they are doing with the MLS deal, and by adding more leagues such as the Pac-12 conference. Apple secured exclusive rights to MLS for $2.5 billion. It’s the one and only traditional sports league that attracts the same demographics as streamers, including Gen Z males, Fortune notes. Another majors news from the last weeks is Apple is eyeing Formula 1 as its next big sports investment. The company is reportedly considering an offer worth about $2 billion per year. The company has been rumored to be considering many deals with various sports leagues, including the NBA, English Premier League, NFL Sunday Ticket, and more. To date, it has landed MLS Season Pass and MLB Friday Night Baseball. Meanwhile, Max added live Sports on Thursday—and built more expensive tiers on exclusive programming.

Cost-cutting prevails: amid the downturn in the tech and media industries, streamers are being pushed to cut spending and turn a profit rather than ‘chasing growth at all costs,’ media analyst Dan Rayburn says. One way streamers have been recouping costs is by cutting the size of their libraries to avoid residual payments and licensing fees. Removing content from platforms is a way for streamers to avoid residual payments and licensing fees. By removing the content specifically made for streaming rather than licensed shows and movies, Warner Bros. Discovery and Disney can immediately cut expenses. Warner Bros. Discovery saved “tens of millions of dollars” after eliminating content, CNBC reported. In the first quarter of the year, the demand for the dozens of shows and movies being cut from Disney+ represented only 1.9% of the total Disney+ catalog, according to data from Parrot Analytics. Another major, and very interesting development, came in July – the HBO-Netflix deal. It’s been reported that Warner Bros Discovery are loaning HBO shows to Netflix to receive a financial boost. The move comes after several HBO series, including Raised by Wolves, Minx and Love Life, were removed from Max. The highest-profile show to receive the chop was Westworld, which was cancelled in 2022.

“The long-term sustainability of all these streaming platforms is uncertain, especially as they grapple with the need to adjust pricing. As they continue to invest in content, they’ll eventually face the inevitability of raising subscription prices yet again. Who will be left standing and who will falter is up for debate, but platforms like Peacock and Paramount+ will be closely watched over the next few quarters as marketers assess their long-term viability”, Insider Intelligence noted in August.

After years of growth, the streaming industry faces a more restrained era. Streaming has changed from a low-priced service with no ads to now ad-supported services, less content, and now at least with Netflix, accounts that cannot be shared with non-household members. What started as a cost-effective alternative to cable TV is now an equally expensive requirement for the modern TV viewer. The streaming business is starting to look less fun for consumers and more costly for the players involved in the fight for paying users, as each company continues to spend billions to stay in it. And turn profit.

Are the ‘streaming wars’ (if they were wars for that matter) over? Or is this just a new chapter? And if yes what will be the next one – ‘gaming wars’ since, according to some analysts, gaming is the most obvious candidate for delivering profits to the big media companies and some players like Netflix are already dipping their toes into this relatively new territory for them? ′

There were several major developments in the past few months: Increasing prices – the latest news is about Netflix once again considering raising subscription prices, this time for its ad-tier (WSJ broke the news). The standard ad-free Netflix experience currently costs users $15.49 per month and is one of three options available to viewers since the service dropped its cheapest ad-free option in July—there’s also a $6.99 ad-supported plan and $19.99 “premium” plan with Ultra HD. Discovery+ owner Warner Bros. Discovery said it will also raise the monthly price of its ad-free tier by $2 for a total monthly cost of $8.99—viewers can see ads on the platform and pay $4.99 (Warner Bros. Discovery also owns pricier streaming service Max). Netflix and Discovery+ join (HBO) Max, Peacock, Paramount+, Starz and AMC Networks-owned Shudder in raising their prices so far this year. Netflix last raised its rate in the first half of 2022, with its most popular plan getting a $1.50 increase. Amazon, which bundles its Prime Video service with its Prime membership program, raised its annual fee by $20 to $139. YouTube TV raised its prices in March, and Hulu With Live TV will join it in October.

The password cracking continues: when Netflix started the password sharing crackdown, many people expected this to be failure. Now many other streamers are following in its footsteps. In fact Disney+ announced that it will begin the process in November. “The cancel reaction was low and while we’re still in the early stages of monetization, we’re seeing healthy conversion of borrower households into full-paying Netflix memberships as well as the uptake of our extra member feature,” Netflix said in its second-quarter investor letter. And it added a net 5.9 million subscribers in the period, a dramatic reversal from the 1.8 million it added in the first quarter.

Ad tiers enter the scene: Netflix, as well as Max and Disney+, have raised rates in recent months and launched cheaper ad-based subscription options for customers, trying to boost revenue in a challenging era and remain competitive with more price-sensitive customers. Netflix too has gone all-in on a lower-cost, ad-supported service, something that its co-founder and now chairman Reed Hastings said for years the company would never do – which says a lot. Most recently, Amazon announced that it plans to introduce “limited” advertising on Prime Video movies and shows, beginning early next year. The company’s release said the U.S., U.K., Germany and Canada will be the first countries to get Prime Video ads, though Amazon didn’t specify the timing beyond “early 2024.” France, Italy, Spain, Mexico, and Australia are set to introduce Prime Video ads later in the year. Most of the major streamers now have some kind of ad-supported tier. Dataxis reported that the 9 territories selected for the launch of advertising in 2024 on Prime Video, Germany, Canada, the US, and later this year the UK, followed by Australia, Spain, France, Italy and Mexico count in total nearly 160 million subscribers, 180 million counting the 22 million from the service in India where Amazon launched a tier with ads in June. As a comparison, the 12 countries in which Netflix’s ad-supported offer is currently available represent a potential audience of around 170 million subscribers. Netflix and Disney+ in late 2022 both introduced lower-cost plans with ads. Prior to that, services like Hulu, HBO Max (now Max) and Paramount+ already offered ad-supported options. Amazon also has a separate free ad-supported streaming TV (FAST) service, Freevee, which users can access through Prime Video or via a standalone app, if they aren’t subscribed to Prime. Apple TV+ is one of the last big-name streamers that’s completely ad-free. But that may change in the future, as Apple in February hired Lauren Fry as head of video ad sales, The Information reported.

Sports becomes even more important: the future of sports belongs to streamers and most likely vice versa. Naturally, the battle for rights is heating up as Apple, Amazon, YouTube, and Peacock try to make their own “ESPN”. Some experts think Apple should buy it, others believe Apple can build it on its own, as they are doing with the MLS deal, and by adding more leagues such as the Pac-12 conference. Apple secured exclusive rights to MLS for $2.5 billion. It’s the one and only traditional sports league that attracts the same demographics as streamers, including Gen Z males, Fortune notes. Another majors news from the last weeks is Apple is eyeing Formula 1 as its next big sports investment. The company is reportedly considering an offer worth about $2 billion per year. The company has been rumored to be considering many deals with various sports leagues, including the NBA, English Premier League, NFL Sunday Ticket, and more. To date, it has landed MLS Season Pass and MLB Friday Night Baseball. Meanwhile, Max added live Sports on Thursday—and built more expensive tiers on exclusive programming.

Cost-cutting prevails: amid the downturn in the tech and media industries, streamers are being pushed to cut spending and turn a profit rather than ‘chasing growth at all costs,’ media analyst Dan Rayburn says. One way streamers have been recouping costs is by cutting the size of their libraries to avoid residual payments and licensing fees. Removing content from platforms is a way for streamers to avoid residual payments and licensing fees. By removing the content specifically made for streaming rather than licensed shows and movies, Warner Bros. Discovery and Disney can immediately cut expenses. Warner Bros. Discovery saved “tens of millions of dollars” after eliminating content, CNBC reported. In the first quarter of the year, the demand for the dozens of shows and movies being cut from Disney+ represented only 1.9% of the total Disney+ catalog, according to data from Parrot Analytics. Another major, and very interesting development, came in July – the HBO-Netflix deal. It’s been reported that Warner Bros Discovery are loaning HBO shows to Netflix to receive a financial boost. The move comes after several HBO series, including Raised by Wolves, Minx and Love Life, were removed from Max. The highest-profile show to receive the chop was Westworld, which was cancelled in 2022.

“The long-term sustainability of all these streaming platforms is uncertain, especially as they grapple with the need to adjust pricing. As they continue to invest in content, they’ll eventually face the inevitability of raising subscription prices yet again. Who will be left standing and who will falter is up for debate, but platforms like Peacock and Paramount+ will be closely watched over the next few quarters as marketers assess their long-term viability”, Insider Intelligence noted in August.

After years of growth, the streaming industry faces a more restrained era. Streaming has changed from a low-priced service with no ads to now ad-supported services, less content, and now at least with Netflix, accounts that cannot be shared with non-household members. What started as a cost-effective alternative to cable TV is now an equally expensive requirement for the modern TV viewer. The streaming business is starting to look less fun for consumers and more costly for the players involved in the fight for paying users, as each company continues to spend billions to stay in it. And turn profit.

Are the ‘streaming wars’ (if they were wars for that matter) over? Or is this just a new chapter? And if yes what will be the next one – ‘gaming wars’ since, according to some analysts, gaming is the most obvious candidate for delivering profits to the big media companies and some players like Netflix are already dipping their toes into this relatively new territory for them? ′